Slower Demand Forecast for Steel

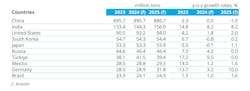

The World Steel Association issued an updated Short Range Outlook report for global steel demand, forecasting a +1.7% rise for 2024 to 1.793 billion metric tons, about 19 million metric tons less than was forecast in a comparable study issued six months ago. The new report also foresees steel demand growing again by 1.2% in 2025, to 1.815 billion metric tons. That would be 34 million metric tons below the forecast amount from October 2023.

World Steel’s Economics Committee issues two semi-annual forecasts for global steel demand, addressing regional and market factors shaping steel consumption.

The forecasters offered that a boost to steel demand could come from “faster than expected disinflation” along with further monetary policy. Major risks to growing demand may be seen in further escalation to geopolitical tensions, continuing inflation, and high and rising public debt causing fiscal consolidation in major economies.

With reference to the the revisions from the earlier report, the forecast states that global steel demand growth remain weak and market volatility will remain high on the lagging effect of monetary tightening, high prices, and high geopolitical uncertainties. Even so, the Committee’s chairman stated there are “early signs of global steel demand settling in a growth trajectory in 2024 and 2025.”

According to chairman Dr. Martin Theuringer: “The global economy continues to show resilience despite facing several strong headwinds, the lingering impact from the pandemic and Russia’s invasion of Ukraine, high inflation, high costs and falling household purchasing power, rising geopolitical uncertainties, and forceful monetary tightening.

“As we approach the end of this monetary tightening cycle, we observed that tighter credit conditions and higher costs have led to a sharp slowdown in housing activity in most major markets, and have hampered manufacturing sector globally,” he continued.

In the Chinese market, the forecast anticipates that 2024 steel demand will remain around the 2023 level, with declining investments in real estate (housing) offset by growth in infrastructure and manufacturing sectors.

Then, in 2025 China steel demand decline further by 1% year-over-year, toward a steel-demand level that is “significantly lower than the recent peak demand year, 2020.

“This projection is also in line with our view that China might have reached its peak steel demand, and the country’s steel demand is likely to continue to decline in the medium-term, as China gradually moves away from a real estate and infrastructure investment dependent economic development model,” according to World Steel.

The projections on Chinese steel demand are related to a downward revision in apparent steel usage for 2023 in China, based on official statistics suggesting a -3.3% decrease, and thus a downward revision of 2023 steel demand growth rate by around five percentage points from the October 2023 forecast.

Excluding China, World Steel projects comparatively strong (3.5% annually) global growth in steel demand 2024-25.

For the United States, steel demand remains steady, and it is expected to return to growth during 2024, thanks to a strong level of infrastructure investment and a gradual recovery in housing demand.

In regard to consumer markets, significant declines in residential construction activity were evident in the U.S., China, Japan, and the European Union, as high interest rates and high construction costs were driving demand downward. Those conditions should continue well into 2024, according to World Steel.

High costs and difficult financing, plus global uncertainty, are depressing manufacturing activity on a global basis, according to the forecast, depressing steel demand from industrial sectors.

The automotive market was an exception to the weak demand in manufacturing sectors, but that may prevent automotive from contributing to a manufacturing recover in 2024.

Some leading indicators show the start of a manufacturing recovery underway now, with heavy investment activity in manufacturing and public infrastructure projects. World Steel predicts that a global transition to green energy programs could contribute to growing demand for steel for construction and manufacturing – though high construction costs and labor shortages may inhibit that possibility in the near term.