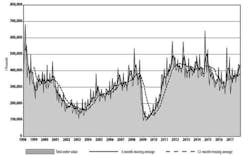

U.S. machine shops and other manufacturers ordered $372 million worth of new manufacturing technology (machine tools and related capital equipment) during January, well lower (-27.3%) than the December order value but significantly higher than the year-ago result. January 2017 new-orders totaled $250.57 million, meaning the current year started 33.3% ahead of the pace set last year.

The data is supplied by AMT - the Association for Manufacturing Technology in its monthly U.S. Machine Tool Orders report, which summarizes actual totals for machine tool sales, nationwide and within six regions. The figures are provided to AMT by participating companies that produce and distribute metal-cutting and metal-forming and -fabricating equipment, including domestically manufactured and imported machinery and equipment.

The volume of new orders for manufacturing technology is a leading economic indicator of economic growth, according to AMT, as manufacturers in various industries invest in capital equipment as they anticipate near-term production increases.

Whereas December order totals often show a significant monthly increase (as manufacturers seek to maximize budgets and capital depreciation opportunities), January orders may be comparatively lower.

However, the year-over-year improvement for January 2018 indicates a more general U.S. industrial expansion.

"The large volumes ordered in January were on par with expectations and indicative of the capacity expansion we expect U.S. manufacturers to pursue throughout 2018 and well into the next year," stated AMT President Douglas K. Woods.

AMT noted several leading indicators for rising demand for manufacturing technology market were strong in December and showed improvements in January, too: manufacturing capacity utilization was 76% for the month; the industrial production index remained at 108; and the Consumer Confidence Index reached 100, "a new cyclical high" — all suggesting a solid first quarter for manufacturing technology demand.

Woods also credited global manufacturing trends for increase in demand for new manufacturing technology. "Still, growth has its challenges, and this tremendous increase in demand is creating shortages in components worldwide," he added.

While only one of the six regions tracked by USMTO recorded an order-volume increase over December 2016, each of them reported a notable rise in demand over January 2017. At $61.99 million, the total value of new orders for metal-cutting machinery in the Northeast region fell 14.3% from the December total, but posted a 32.6% rise over the January 2017 result.

In the Southeast, January metal-cutting machinery orders fell to $36.58 million, down 27.3% from December, but 33.3% higher than the comparable figure for January 2017.

Total manufacturing technology orders in the North Central-East region during January fell 19.7% from December, to $83.19 million. That represents a 28.6% improvement from the January 2017 total.

The North Central-West region reported total manufacturing technology new orders of $78.20 during January 2018, 23.0% less than in December but 68.5% more than in January 2017.

Metal-cutting machinery orders for January rose slightly to $47.21 million in the South Central region, up 7.4% from December and up 122.8% from the January 2017 report.

Finally, the West region had metal-cutting machinery orders of $60.73 million during January, 24.5% less than during December but 22.2% higher than during January 2017.