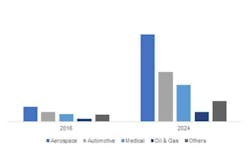

The market for component parts produced by additive manufacturing with metal powders is forecast to exceed $1.1 billion by 2024, according to a new research report by Global Market Insights Inc. There are several contributing trends informing this outlook:

In manufacturing, an increasing trend toward adoption of prototypes has led to the development and validation of design faster, and also promoted reductions in production time and cost in various industrial sectors, which has stimulated the demand for additive manufacturing with metal powders.

In another exemplary factor, increasing levels of exploration and production (E&P) in the oil-and-gas sector has prompted manufacturers to undertake various technological advances in 3D printing, for more efficient oil recovery.

There are multiple positive applications of AM metal parts in aerospace, including engine components, turbine parts, and interior fittings, which should trigger further growth in demand for additive manufacturing with metal powders in that market. Already over 20% of aerospace engineering companies are using this technology to make tooling components. The industry is making constant efforts to minimize aircraft weight by using lightweight metals, such as stainless steel, titanium, aluminum, and copper. Growing confidence in AM technologies by aerospace manufacturers should minimize the costs for developing models and prototypes, resulting in additive manufacturing with metal powders market growth.

The market for AM with metal powders for oil-and-gas applications is likely to be valued at over $45 million over the projected timespan. Prototyping and modelling for exploration and operational equipment, chemical injection stick tools, gears, impellers, pipeline rigs, nozzles for downhole cleanout tools, control valve components, large-scale downhole tools and sealing accessories, including O rings, are produced now via 3D printing. Increased usage of these technologies in making complex components for oil-and-gas industries, while cutting costs, reducing emissions and boosting performance, should trigger further demand additive manufacturing with metal powders.

In the U.S., the market demand for AM with metal powders market size may exceed $400 million during the forecast timeframe. Growing health concerns, an ageing population, and the variety of long-term chronic diseases, coupled with strong regulatory standards regarding medical devices, should propel regional demand for medical and surgical instruments, devices, and implants. Improvement in patients’ long-term outcomes for surgeries and treatment, along with growing demand for rehabilitation care, should prompt U.S. regional expansion of technologies for AM with metal powders technology.

Stainless steel, aluminum, cobalt, nickel and titanium powders are the prominent raw materials used in the additive manufacturing with metal powders method. Infringement laws regarding the product and the technology, along with volatility in regional raw material prices, may impact the demand-supply gap and hinder industry profitability.

Demand for aluminum alloys for additive manufacturing should witness gains over 27% up to 2024. Components manufactured from aluminum powders have commercial applications in automotive, motor racing, and general engineering sectors, as it is light and rigid. Superior properties such as corrosion resistance, durability, and welding functionality, make aluminum metal powders suitable for automotive part designs, thus enhancing product demand.

Demand for AM metal powders for powder-bed fusion (PBF) technologies would surpass $950 million by 2024. This technique, along with titanium powders, is widely used to make orthopedic devices due to cost-effectiveness and lead-time efficiency. In particular, the direct metal laser sintering (DMLS) technique is effective for making prototypes and finished products.

In the U.K., demand for additive manufacturing with metal powders should see growth at over 25% during the forecast timeline. The Laser Engineering Net Shape (LENS) and Electron Beam Melting (EBM) techniques are widely used to produce complex geometrical structures for the automotive and aerospace sectors. Increased production rates and increasing sales for motor vehicles, along with increasing demand of lightweight vehicles in the region, should sectoral growth for metal AM technologies.

General Electric, 3D Systems, EOS, Pratt & Whitney, Optomec, Renishaw, Arcam, ExOne and Trumpf are the some of the industrial groups active in the market for additive manufacturing with metal powders. Manufacturers are engaging in partnerships and collaborations to strengthen their global presences, along with increased investments in AM equipment and research to develop the technologies further, which also may drive metal 3D printing market demand.

Kunal Ahuja is the manager, Chemicals and Materials, with Global Market Insights Research Pvt. Ltd., Pune, India. He has over four years of experience in the chemicals and materials sector, and expertise in strategy building, handling consulting assignments, and publishing syndicated market research studies. Contact him at [email protected]