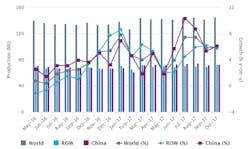

Steelmakers around the world combined to produce 145.25 million metric tons of raw steel during October, improving on the September total by 2.6% and besting the October 2016 result by 5.9%. The results for 66 countries, reported by the World Steel Association, continue to demonstrate a renewed stability in global manufacturing and construction markets, following more than two years of weak demand and instability.

Through the first ten months of 2017, the global steel industry has produced 1.41 billion metric tons of raw steel, 5.2% more than during the comparable January-October period of 2016.

World Steel Assn. reports monthly raw-steel output and capacity utilization for 66 nations. Raw (or crude) steel is produced by basic oxygen furnaces and electric arc furnaces, and cast into semi-finished products, such as slabs, blooms, or billets. The monthly report covers carbon and carbon alloy steels; data for production of stainless and specialty alloy steels are reported separately.

In October, World Steel issued a semi-annual short-term outlook for global steel demand, project total 2017 to up slightly to 1.6 billion metric tons, with improved demand in China and the developed economies, less political and social instability in China and elsewhere, and more strength in the construction and machinery sectors.

Also proving the recent improvements is the global raw-steel capacity utilization rate. World Steel reported it at 73.0% for October, which is slightly (-0.6%) below the September rate, but 3.0% higher than the October 2016 rate.

As always, the Chinese steel market sets the picture for the industry worldwide. At 72.4 million metric tons of output during October, Chinese raw-steel production increased slightly less than 1% from September, but the improvement was 6.1% from October 2016. With 709.5 million metric tons produced through 10 months of 2017, the Chinese industry has raised its year-to-date output by 5.23% over the 2016 output.

In Japan, steelmakers produced 9.0 million metric tons of raw steel during October, which improved on the September output by 4.0%, and fell behind the October 2016 total by only -0.98%. For the January-October 2017 period, with 87.2 million metric tons produced, the Japanese industry trails its 2016 total by just -0.23%.

The up-and-coming Indian steel industry produced 8.6 million metric tons of raw steel during October 2017, 2.71% more than during September and 5.3% more than in October 2016. India’s YTD output is 84.1 million metric tons, 6.4% higher than its total for the comparable 10-month period of 2016.

South Korea’s steel industry produced an estimated 6.2 million metric tons during October 2017, 3.33% more than during September, and that figure is 2.6% higher than last October’s result. For the January-October period, the South Korean industry has produce 59.1 million metric tons of raw steel, 3.7% more than it produced last year over the comparable period.

Across 28 nations of the European Union, October raw-steel production totaled 12.4 million metric tons, 6.8% more than during September and 3.4% more than during October 2016. Total YTD production for the region is 140.76 million metric tons, or 3.7% higher than the total for January-October 2016.

The largest steelmaking country in the region is Germany, which had October raw-steel production estimated at 3.6 million metric tons, a 2.6% rise over the September total and a 2.7% improvement over the October 2016 total.

The Italian steel industry posted October raw-steel output of 2.3 million metric tons, a rise of 3.6% over September and of 6.1% over October 2016. The nation’s year-to-date raw-steel production total stands now at 20.1 million metric tons, which is 3.05% more than 2016’s 10-month result.

In France, the October raw-steel production total was 1.4 million metric tons, an increase of 2.7% over the September total and of 1.6% over the October 2016 total. Even more impressive, the YTD total for French steelmakers is up to 13.1 million metric tons, which is 9.5% higher than the total for the same 10-month period of 2016

Spanish steelmakers produced 1.3 million metric tons during October, a 4.15% improvement over September and an 11.9% increase over October 2016. The YTD total for Spain is 11.8 million metric tons, 2.0% higher than last year’s figure.

In Russia, the October raw-steel production is estimated at 6.22 million metric tons, 3.3% higher than during September and 4.75% higher than during October 2016. Russian steelmakers’ 10-month production total for 2017 is 60.4 million metric tons, 3.0% higher than the total for 2016’s first 10 months.

Steelmakers in Ukraine produced 1.9 million metric tons during October, improving their September total by 3.5% and yet falling 4.7% behind last October’s total. For the January-October period, Ukrainian steelmakers have produced 18.0 million metric tons, a decrease of 10.9% over the total for 10 months of 2016.

Turkey’s raw steel production total for October 2017 was 3.3 million metric tons, up by 10.2% over September and up 11.1% over October 2016. The YTD production stands at 31.05 million metric tons, which is 13.3% higher than the January-October 2016 result.

Brazilian steelmakers produced 3.0 million metric tons during October 2017, 2.9% more than September and 3.85% more than October 2016. For the year-to-date, Brazil’s steel industry has produced 28.5 million metric tons of raw steel, 8.5% more than last year’s January-October total.

Finally, the U.S. steel industry produced 7.0 million metric tons (7.72 short tons) of raw steel in October 2017, 4.9% more than during September and 12.0% more than during October 2016. For the January-October period, the U.S. steel producers have cast 68.4 million metric tons (75.4 million short tons), 3.9% more than last year’s 10-month running total.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.