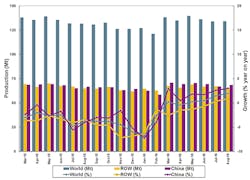

Steel production worldwide totaled 134.1 million metric tons during August, rising only slightly (0.2%) from the July result and a bit higher (1.95%) than the August 2015 figure. Global raw-steel capacity utilization during August was just 68.5%, just 0.1% higher than the utilization rate for July, and 0.5% less than the rate during August 2015.

The data is drawn from the monthly summary issued by the World Steel Association, which tracks steel production and capacity utilization rates across its 66 member nations.

Raw (or crude) steel is the output of basic oxygen furnaces and electric arc furnaces that is cast into semi-finished products, such as slabs, blooms, or billets. The World Steel Association reports tonnage and capacity utilization data for carbon and carbon alloy steel in 66 countries; data for production of stainless and specialty alloy steels are not included.

The relative stability indicated by the August production totals is noteworthy, coming after several months of falling output. Earlier this year, World Steel issued an outlook report predicting that the final 2016 raw steel production totals would show a year-on-year (-0.8%) decline in global steel demand. It forecast this year’s total raw steel production would be 1.488 billion metric tons, following last year’s -3.0% annual decline global steel production (1.62 billion metric tons.)

Through August, the world’s steelmakers have produced 1.065 billion metric tons, 0.72% less than the eight-month total for 2015.

In China, which typically produces about half of the world’s raw steel total, August raw steel production rose 2.64% from July, to 68.6 million metric tons. That total is 3.0% higher than last August’s result, and brings China’s year-to-date production total to 546.2 million metric tons, virtually even (+0.18%) with the comparable eight-month total for 2015.

Japan’s steelmakers produced 8.9 million metric tons during August, 0.66% less than during July but 3.0% more than during August 2015. The YTD raw steel total for Japan is 69.9 million metric tons, 0.4% less than the comparable 2015 total.

The Indian industry produced 8.14 million metric tons for the month, 0.73% more than during July but 9.39% more than during August 2015. The January-August total is 63.2 million metric tons, 5.6% higher than the eight-month result for last year in India.

In South Korea, the August raw-steel production total was 5.87 million metric tons, 2.4% lower than the July result but 1.8% higher than the August 2015 figure. For the current year, South Korean steelmakers have produced 45.2 million metric tons, 2.1% less than they produced at the comparable date in 2015.

Among the world’s major steelmaking regions, the European Union had the least impressive August results: most of the large producer nation’s schedule maintenance and repair projects during the customary vacation summer vacation period, and across the 28 nations the total production for the month of August was 11.97 million tons, 8.75% less than during July, 1.43% less than during August 2015, and 7.56% less than the 2015 YTD total.

German steelmakers produced 3.5 million metric tons during August, 3.48% more than during July and 2.36% more than during August 2015. Through August, the German industry has produced 28.78 million metric tons of raw steel, 1.48% less than last year’s January-August total.

The Italian industry produced 1.08 million metric tons of raw steel during August, 47.9% less than during July but 7.36% more than during August 2015. Total YTD tonnage for Italy’s steelmakers is 15.3 million metric tons, 4.43% above last year’s figure.

Spanish steelmakers produced 1.04 million metric tons during August, 12.86% more than during July, but 11.8% less than during August 2015. Their YTD figure is 9.3 million metric tons, 7.56% lower than the 2015 eight-month total.

In France, August steel production fell 13.12% from the previous month to 932,000 metric tons, which is also 5.23% lower than the August 2015 total. The French YTD steel output is 9.34 million metric tons, 10.25% lower than last year’s January-August total.

Turkish producers reported 2.9 million tons of raw steel produced during August, 7.2% more than during July and 12.9% more than during August 2015. The Turkish industry’s total output for 2016 stands at 22.0 million, 4.7% above its eight-month total for 2015.

In Russia, August raw-steel production fell 2.2% from July’s result to 5.9 million metric tons. That result is 1.9% lower than the August 2015 figure, and brings Russia’s YTD production total to 47.03 million metric tons, 1.55% less than last year at the comparable date.

Ukraine’s steelmakers produced 1.84 million metric tons during August, 11.36% less than during July and 4.06% less than during August 2015. Their January-August output is reported to be 16.33 million metric tons, 8.57% higher than last year’s eight-month result.

Brazil’s raw steel production during August was 2.7 million metric tons, 2.32% more than the July figure but 1.1% less than the August 2015 total. Brazilian steelmakers’ YTD total tonnage for 2015 is 20.34 million metric tons, 10.65% less than the January-August 2015 total.

Finally, steelmakers in the United States produced 6.7 million metric tons (7.4 million short tons) during August, 0.09% more than during July and 3.4% less than during August 2015. Their January-August output totals 53.45 million metric tons (58.9 million short tons, and that total is 0.9% less than last year’s eight-month output.