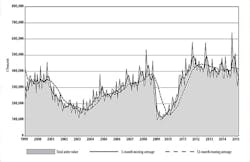

U.S. manufacturers and distributors of machine tools recorded new orders totaling $399.83 million during March, an increase of 30.3% from February’s total of $306.96 million, and yet a decrease of 18.7% compared to the $491.73 million recorded for March 2014. The latest result brings 2015 year-to-date machine tool orders to $1.05 billion, down 12.7% compared to the comparable three-month period of 2014.

Investments in machine tools are an indicator of manufacturing confidence because of their role in the production of engineered components. AMT – the Association for Manufacturing Technology compiles the United States Manufacturing Technology Orders (USMTO) report to track production and distribution of “manufacturing technology” nationwide and on a regional level, for both domestic and imported machine tools and related equipment.

The figures are supplied by AMT cover orders for metal-cutting and metal-forming and –fabricating equipment, and are supplied by companies participating in the USMTO program.

“There are many indications that our end-user customers are making significant investments in their manufacturing facilities to increase capacity, including GM’s announcement that it will invest billions in its U.S. plants,” according to AMT president Douglas K. Woods. “Overall we expect the industry to hold steady with a push-pull between strong domestic investment in manufacturing but a drag on foreign trade due to the dollar’s strength.”

The USMTO’s six regional are not an accurate reflection of the current data, AMT cautions, due to revisions in the geographic coverage since 2014 and variations in data reporting. AMT notes that the report’s data is adjusted to reflect this change, but some categories remain unreported.

In the Northeast, March metal cutting equipment orders rose 16.5% from February, and total equipment orders rose 6.2% to $72.16 million during March. The region’s 2015 year-to-date manufacturing technology orders now stand at $222.69 million, 11.8% higher than the January-March 2014 total.

The Southeast region reported March metal-cutting equipment orders totaling $31.72 million, a rise of 6% rise from February, but a 15.6% decline from the March 2014 result. Year-to-date, the region has posted new metal-cutting equipment orders totaling $87.36 million, or 14.5% less than the first-quarter result for 2014.

In the North Central-East region, total new orders for machine tools during March rose to $116.75 million, 56.1% more than the February total but 41.7% less than the March 2014 result. During the first three months of 2015, the region’s orders totaled $283.99 million, a decline of 22.9% versus the comparable period of 2014.

The North Central-West region posted metal-cutting equipment orders totaling $82.59 million, a 9.9% increase from February and a 22.3% increase from the March 2014 result. For the year-to-date, total manufacturing technology orders in the region rose 23.9% to $216.13 million, compared to the January-March 2014 total.

The South Central region posted new orders for metal-cutting equipment totaling $30.33 million, up 20.5% versus the February result, but down 51.1% versus the March 2014 result. For the year-to-date, the region’s manufacturing technology orders stand at $84.91 million, down 51.9% the comparable January-March 2014 period.

Finally, in the West region, new orders for metal-cutting equipment rose to $64 million, up 71.0% from February and 20.3% from March 2014. For first three months of 2015, total manufacturing technology orders in the West region are now worth $150.45 million, down 15.0% versus the March 2015 total.