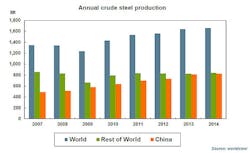

Global raw steel production totaled 1.64 billion metric tons in 2014, an increase of 1.2% over the 2013 total according to results released by the World Steel Association. The modest increase worldwide was mirrored by similar results in the major steel producing nations and regions, as China’s output increased just 0.9%, Japan’s rose 0.1%, and Germany’s improved 0.7%.

U.S. steelmakers’ output increased 1.7% over the 2013 total.

The data is collected and reported by the World Steel Assn., which tracks raw (or crude) steel tonnage and capacity utilization across 65 countries. Raw steel is the product of electric arc furnaces and basic oxygen furnaces, prior to metallurgical refining and casting

into semi-finished products, such as slabs, blooms, or billets. World Steel’s results include data for carbon and carbon alloy steel output. Stainless steels and other specialty alloy steels are not included.

The final results for 2014 included a 2.6% increase from November to December, with global tonnage rising to 133.7 million metric tons. That also represented an increase of 0.1% compared to December 2013.

The industry’s average capacity utilization in 2014 was 76.7%, compared to 78.4% in 2013. Global capacity utilization during December 2014 was 72.7%, down 0.9% from November and down 2.4% from December 2013.

The December results offered an encouraging note on which to end a year that showed little evidence of growth in steelmaking. In October, World Steel forecast a short-range outlook for declining rates of increase for global steel consumption, anticipating that global steel consumption in 2014 will rise just 2.0% over the 2013 “apparent steel usage”, to 1.56 billion metric tons, and for that to be followed a further 2.0% increase to 1.59 billion metric tons for 2015.

China has dominated global steel production for the past 15 years, with its monthly output frequently comprising half or more of the world’s total volume. For 2014, Chinese raw steel production represented 49.5% of the world’s total, down from 49.7% of the total in 2013.

China’s 822.7 million metric tons produced in 2014 represented an increase of 0.9% over 2013, indicating the progress of China’s efforts to consolidate its carbon steel production capacity.

Among the other top steelmaking nations, Japan produced 110.7 million metric tons in 2014, a 0.1% increase from 2013, and South Korean output increased 7.5% to 71.0 million metric tons for the year.

The 27 countries of the European Union are second to Asia among the world’s largest steel-producing regions, and the region produced 169.2 million metric tons of crude steel in 2014, a 1.7% increase in versus 2013.

Germany produced 42.9 million metric tons of raw steel in 2014, up by 0.7% over 2013. Italy produced 23.7 million metric tons in 2014, a 1.4% decrease, while France’s raw steel production in 2014 was 16.1 million metric tons, up 2.9%. Spain produced 14.2 million metric tons of raw steel in 2013, down 0.6% compared to 2013.

Raw steel production in North America rose 2.0% in 2014, totaling 121.2 million metric tons. U.S. raw steel production for the year rose 1.7% to 88.3 million metric tons, or 97.35 million short tons.

December U.S. raw steel product was 7.4 million metric tons, or 8.13 million short tons, which was 2.3% higher than the November total.