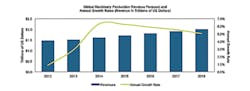

A newly released research study finds that strong demand for capital machinery across a wide swathe of industries will drive the machinery market to new peaks in the current five-year period. The study, “The Machinery Production Market Tracker,” prepared and issued by IHS Technology, foresees a doubling of the sector’s growth rate this year.

The report finds that economic conditions are improving worldwide, and states that demand for machines for agricultural use, packaging, material handling, and machine tools will drive a 6.3% annual improvement in revenues this year, up to an estimated $1.6 trillion, from $1.5 trillion in 2013.

IHS further forecasts that growth will continue through 2018, with revenue rising to $2.0 trillion by that year.

Over the five-year period, the study forecasts that the machinery market’s annual growth rate will average 5 to 6%.

“The improving economic outlook is a key factor in the strong growth of machinery in the coming years,” stated senior analyst for industrial automation Andrew Robertson. “The growing populations and the expanding middle classes in developing countries are generating more disposable income. This translates into increased demand across a vast number of sectors.”

The report finds that the current year’s sales growth for industrial machines is driven by several factors, starting with strong global automotive demand, which is promoting sales of tools and automation systems. Auto demand is also driving capital spending in the rubber and plastics markets.

Increases in food processing and packaging machinery are being driven by rising standards of living around the world. Increased investment in technology products will improve demand for robotics, semiconductor equipment, mining, and oil and gas machinery, the report offers.

Also increasing is the demand for housing, infrastructure and commercial buildings, which is driving spending for construction equipment.

In the coming years, the packaging sector is marked for growth, in particular for lighter packaging materials and systems that require less material and is more energy efficient to produce.

IHS forecasts a change in the Chinese industrial machinery market. Over the past two years, that market has endured considerable overcapacity in construction machinery, machine tools, and metal working sectors. Machinery production revenue slowed to 1.8% growth in 2012, and weak investment in 2013 weighed down many industries there.

Now, IHS predicts production revenue growth increases of 10.9% and 8.1% in the Chinese market during the coming two years.