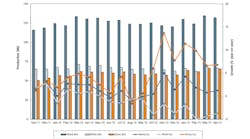

Global raw steel production declined -3.4% or 4,650 million metric tons during June, falling from 136,302 million metric tons in May to 131,652 million metric tons for the most recent month. The result was reported by the World Steel Assn., the Brussels based trade group that represents steelmakers in 64 countries.

World Steel Assn.’s data comprises “raw” steel production, the primary output of electric arc furnaces and basic oxygen furnaces, prior to metallurgical refining and casting into semi-finished products, such as slabs, blooms, or billets. The monthly report totals the global carbon and carbon alloy steel output; stainless steels and other specialty alloy steels are not included.

The June totals appear more favorable in the year-to-year comparison, climbing 1.9% versus the June 2012 result.

Worldwide raw steel capacity utilization during June fell to 79.2% from 79.6% in May. Compared to June 2012, the new rate is 1.5% lower.

For the first six months of 2013 global steel production has totaled 789,796 million metric tons, 2.0% above the comparable result for 2012.

World Steel noted that most recent month’s declines were borne by producers across all regions: the EU (-3.6%); the former Soviet states (-1.4%); North America (-4.3%); and South America (-6.5%).

Asian steel production also decline for the month, by -3.4%, countering the recent trends that have seen steelmakers in China, Japan, and elsewhere in the region offset declines in other parts of the world.

Momentum Still in Asia

However, while most regional markets also reported year-on-year declines in June production, Asian steel output increased 3.5% for the June and 5.5% for the first half of 2013.

In other regional six-month comparisons, the EU nations produced -5.1% less than during January-June 2012; the C.I.S. region decreased 3.0%; North America produced -5.8% less; and South America produced -4.6% less than a year ago.

China’s raw steel production for June 2013 was 64,660 million metric tons, down 3.5% from May but up by 4.6% compared to June 2012.

Japan produced 9,281 million metric tons in June, a decrease of 3.5% from May but an increase of 0.9% compared to June 2012. South Korea’s raw steel production was 5,458 million metric tons in June 2013, off the May result by 9.9% and down by -5.4% from June 2012.

Steelmakers in Germany produced 3,365 million metric tons of raw steel in June 2013, 8.7% less than in May and 2.2% less than in June 2012.

Italy’s raw steel production was 2,188 million metric tons, down by 5.5% from May and down by 10.3% versus June 2012.

In June 2013, Russia produced 5,698 million metric tons of raw steel, a decrease of 6.4% from May, and a decrease of 0.8% versus May 2012.

U.S. steelmakers 7,221 million metric tons of raw steel in June 2013, just barely more than the 7,522 million metric tons produced during May, and down by -0.2% from the June 2012 result.

In Brazil, June raw steel production totaled 2,831 million metric tons, falling 6.0% from the May total but increasing 2.7% compared to June 2012.