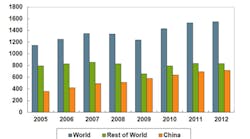

The trade association representing the world’s primary steelmakers issued a short-range forecast of global steel consumption, predicting a 2.9% increase in “apparent steel use” this year, to a total of 1.454 billion metric tons. In the following year, the association predicts global steel consumption will rise a further 3.2% and reach 1.5 billion metric tons for 2014.

The World Steel Assn. represents steelmakers in 62 countries. It released its Short Range Outlook (SRO) for 2013 and 2014 during a meeting of its Economics Committee, April 6-7.

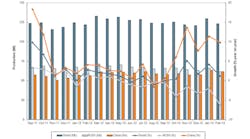

The 2013-2014 offers encouragement after the past year of declining demand. In 2012, global steel consumption grew just 1.2%. Total world steel production last year was 1.548 billion metric tons.

“2012 was a challenging year for the steel industry, with apparent steel use increasing at the slowest rate since 2009, when demand declined by -6.5%,” World Steel Economics Committee chairman Hans Jürgen Kerkhoff noted. “This was mainly due to the Eurozone crisis, which persisted throughout 2012 and whose impact was felt further afield.

“On top of this, corrective macroeconomic measures in major emerging economies also contributed to a concerted slowdown globally,” Kerkhoff continued.

However, the economist noted that recently the primary risks to the strength of the global economy – the Eurozone crisis, a hard landing for the Chinese economy, and the U.S. ‘fiscal cliff’– have stabilized considerably “We now expect a recovery in global steel demand to kick in by the second half, led by the emerging economies,” he said.

The World Steel Assn. outlook seems more positive than that of 150 steelmakers, suppliers, and buyers, surveyed by Platts: that media group for the energy and metals commodities sectors cited poll results that identify oversupply and a weak global economy as the greatest challenges to the European steel industry.

Kerkhoff cautioned that, “the situation on the financial markets remains fragile, and the Eurozone crisis is far from being solved as the recent events in Cyprus have again shown. In 2014, we expect a further pickup in global steel demand with the developed economies increasingly contributing to growth.”

Asian outlook

China is the largest steel-producing nation, and though its steel production total rose 3% last year its total consumption rose just 1.9%. World Steel forecasts apparent steel use in that country to grow by 3.5% in 2013, to 668.8 million metric tons. That would be followed by a further 2.5% consumption increase in 2014 – assuming successful efforts by the Chinese government to limit investment in the steel industry, part of its effort to redirect economic development.

Following 2.5% growth in 2012, India’s steel demand is seen rising by 5.9% to 75.8 million metric tons in 2013, as monetary easing is expected to promote private-sector investment. In 2014, growth in steel demand is expected to increase 7.0%, as a result of deficit-reduction efforts and other measures to improve the foreign direct investment.

In Japan, steel demand is forecast to decline 2.2% this year to 62.6 million metric tons, a result of declining shipbuilding and automotive production. It would be the second consecutive year of declining consumption in that country.

And, for 2014 the forecast sees further declining consumption in Japan, by -0.6%, due to an end to fiscal stimulus efforts and other structural changes, e.g., offshoring of Japanese manufacturing.

U.S. and Western Hemisphere

In 2013, in the US, after growth of 8.4% in 2012 due to the automotive and energy sectors and an increasingly resilient construction recovery, apparent steel use is forecast to grow by 2.7% to 99.3 million metric tons due to continuing fiscal concerns. In 2014, steel demand is expected to increase by 2.9%, thus exceeding 100 million metric tons with the help of positive momentum from the construction sector. For NAFTA as a whole, apparent steel use will grow by 2.9% and 3.0% in 2013 and 2014 respectively.

In Central and South America, the World Steel Assn. forecasts apparent steel consumption to increase by 6.2% in 2013, to 49.8 million metric tons from 2.6% growth in 2012. Steel demand in the region is forecast to grow by 4.3% to 52.0 million metric tons in 2014.

In Brazil, rising capital investments and an end to steel-inventory sell-offs this year are forecast to drive up apparent steel consumption by 4.3% to 26.2 million metric tons. The growth trend will continue at a pace of 3.8% in 2014, to 27.2 million metric tons in 2014.

EU, C.I.S., and beyond

World Steel forecasters see “lingering uncertainties” in the European economic zone (the EU27), details stemming from the Euro crisis that negatively affected economic activities in the region, especially during the last quarter of 2012. Apparent steel use in the EU27 for 2012 fell -9.3%.

The decline was worse in some countries, notably in Italy and Spain where apparent steel use contracted by more than -18% in 2012. Describing “signs of stabilization” in the regional economy, the World Steel is forecasting a weak recovery for the EU27 late in 2013. Steel demand in the region is seen contracting by -0.5% in 2013, followed by growth of 3.3% in 2014 to 144.1 million metric tons.

In the former Commonwealth of Independent States, growth of steel consumption is forecast to slow to 2.0% in 2013, to 57.6 million metric tons. Increases in Russian consumption will offset declining demand in the Ukraine and Kazakhstan.

Then, in 2014, C.I.S. regional steel demand will grow 3.8% to 59.8 million metric tons as regional market factors improve. This would include resumption of energy projects and improving construction activity in Russia, where steel demand is forecast to rise 2.6% to 42.9 million metric tons in 2013, and 3.9% to 44.6 million metric tons in 2014.

Growth of apparent steel use in the CIS region is projected to slow to 2.0% reaching 57.6 million metric tons in 2013 as the modest pickup in Russia is partially mitigated by declining demand in Ukraine and Kazakhstan. In 2014, steel demand in the region is expected to grow by 3.8% to 59.8 million metric tons with the improving external environment. The resumption of energy projects and improving construction outlook is expected to support steel demand in Russia. It is forecast that steel demand in Russia will grow by 2.6% to 42.9 million metric tons in 2013 and will grow further by 3.9% to 44.6 million metric tons in 2014.

Finally, in the Middle East/North Africa region, steel demand is

Steel demand in the MENA region is forecast to grow 3.2% to 65.2 million metric tons in 2013, following 2.2% growth in 2012. In 2014, the regional steel demand will grow again by 7.1% to 70 million metric tons, mainly due to strong demand from the construction sector.