Market analysis by IHS Inc. is forecasting that industrial machinery production in China will expand by 11% during 2013, with a total market value estimated at $426 billion. The study concerns a wide range of manufacturing sectors, including agricultural and construction machinery, electronics and electronic assembly, furnaces and burners, machine tools, material handling equipment, paper and paperboard machinery, printing machinery, robotics, rubber and plastic machinery, semiconductor machinery, textile machinery, woodworking machinery, PV manufacturing machinery, and wind turbines.

IHS noted that the same broad market sector grew by less than 10% during 2012, calling that “the lowest rate in many years,” as a result of weak exports and low levels of domestic investment.

“Prior to the slowdown, China’s machinery production had expanded by a robust 20% in 2011 to $379.8 billion,” IHS reported. Economic performance was strong in 2010 too, due to a $643 billion stimulus program implemented in 2009.

The decline actually began in the second half of 2011, according to IHS, a result of economic “overheating” and increasing inflation. Then, the central government implemented policies that tightened the money supply, but other problems remained.

“Many industries in China suffered from significant over-capacity in 2012, including construction machinery production, paper and paperboard production, and photovoltaic manufacturing to name a few,” according analyst Jay Tang, author of the IHS report, “The Machinery Production Yearbook – China – 2013.”

“The Chinese government will likely maintain a tightening policy in the first half of 2013, but this won’t continue in the second half because of a bad export situation and the slowdown in economic growth,” Tang indicated.

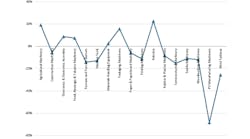

The Chinese economy is heavily dependent on exports to drive growth, and weak demand in the U.S. and the European Union economies during 2012. Some of China’s sectors that were notably affected by weak offshore demand during 2012 were those manufacturing cranes and machines for rubber and plastics, semiconductors, textiles, woodworking, and metalworking.

China’s machine tool builders endured a decline of more than 10% from 2011 to 2012.

Some industries that have greater exposure to domestic activity performed better than the average during 2011-2012. These included agricultural machinery; electronics and electronics assembly; food, beverage & tobacco machinery; packaging machinery; and industrial robotics.

Recovery signs emerged late in 2012, including rising real estate activity and railroad investments.

However, IHS predicted that the Chinese government would be cautious with any new stimulus policy, in order not to repeat the perceived excesses of its 2009 activity.

China’s economic growth also will be limited by continued weakness in the global economy, notably in the European Union, as well as by low levels of non-stimulus spending in its own domestic market.