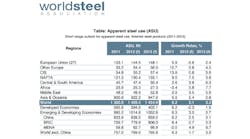

The World Steel Association — the trade group representing the international primary steel industry — is forecasting slower increases in demand for the remainder of 2012 and into 2013, though total consumption is seen increasing. The outlook was issued in coordination with the group’s annual general meeting in New Delhi, and is notable for its sober revision to the group’s last short-term forecast. Now, World Steel is anticipating that 2012 global steel consumption will rise 2.1% to 1.409 billion, a considerably lower forecast than the group issued six months ago. In April, World Steel’s semi-annual short-range outlook called for 2012 consumption to reach 1.422 billion metric tons.

Though the revised total still would be an annual increase over 2011 (1.381 billion metric tons), the outlook now recognizes how much steel demand has slowed during 2012, from a 6.2% rate of increase in 2011 to 2.1% for the current year.

For 2013, the association is forecasting steel demand will grow by 3.2% to an annual total of 1.455 billion metric tons. More specifically, the group sees steel demand growing by 3.0% in the developing and emerging economies (including China and India) during 2012, and a further 3.7% in 2013. However, overall demand will contract -0.3% for 2012 in the world’s developed economies (especially in the European Union), but rise again by 1.9% in 2013.

“Earlier this year we were seeing some signs of recovery from the slowdown of the last quarter of 2011, and we expected a better second half performance in 2012,” explained Hans Jürgen Kerkhoff, who chairs the World Steel Assn.’s Economics Committee. “However, the economic situation deteriorated during the second quarter of this year due to continued uncertainty arising from the debt crisis in the Euro zone, and a sharper than expected slowdown in China. These factors have weighed heavily on business confidence and manufacturing activities around the world. As a result momentum in both the developed and emerging part of the world weakened considerably.

"However, we expect the situation to gradually improve in 2013,” Kerkhoff continued, “on the basis that the Euro zone crisis can be contained, the U.S. successfully deals with the fiscal tightening due in 2013, and the economic stimuli measures secure a soft landing in China.”

China slows down

China has been leading the world in steel consumption and production for most of the past decade. The new forecast see steel demand in China increasing 2.5% to 639.5 billion metric tons in 2012, having grown 6.2% to total 623.9 billion metric tons in 2011.

In 2013, the forecasters expect Chinese government stimulus to have a moderately positive effect on the economic situation there, which has been adversely impacted by the global economic decline and the consequent slow-down in Chinese steel exports.

Assessing the entire situation, the World Steel outlook anticipates Chinese steel demand to increase 3.1% in 2013, to a total of 659.2 billion metric tons.

Global conditions also are slowing steel output in India. The forecasters predict India’s rate of increase in steel demand will slow to 5.5% in 2012 and 5.0% in 2013. Steel consumption in India is forecast at 73.6 billion metric tons for 2012 and 77.3 billion metric tons in 2013.

Slower growth for NAFTA

Steel consumption in the NAFTA region is forecast to rise 7.5% in 2012, from 121.3 billion metric tons in 2011 to 130.4 billion metric tons this year. The study cited increases in the automotive and construction markets.

However, the 2013 outlook for the NAFTA region anticipates but slower growth, at 3.6% to total consumption 135.1 billion metric tons.

Most of Central and South America steel consumption will rise 3.8% in 2012, from 45.7 billion metric tons in 2011 to 47.4 billion metric tons, but in 2013 it is forecast to grow 6.3% to 50.4 billion metric tons.

The European Union’s sovereign debt crisis is cited as the cause of steel consumption falling in -5.6% in the EU 27, from 153.1 billion metric tons in 2011 to a forecast 144.5 billion metric tons for 2012. The World Steel forecasters cited 2012 declines for steel consumption in Spain (-11.9%) and Italy (-12.6%), but also noted even Germany will see a decline of -4.7% in steel consumption this year.

In 2013, EU 27 steel consumption is forecast to improve by 2.4% over the current year, to 148.1 billion metric tons. “Steel demand in Europe, however, remains at a depressed level and economic growth between countries continues to be uneven,” according to World Steel.

In Japan, steel consumption is rising 2.2% to 65.5 billion metric tons this year, on the strength of reconstruction spending and government stimulus measures. However, Japanese manufacturing is struggling because of a strong yen and declinging exports, according to the forecasters. World Steel predicted that in 2013 Japanese steel demand will decline furthers, by -2.9% to 63.6 billion metric tons.

Steel consumption had been very strong in Russia and the C.I.S. region during 2011, increasing 13.8% over the year earlier to 54.8 billion metric tons. Now, steel consumption is forecast to rise just 0.8% in 2012, and will total 55.2 billion metric tons. It will rising 3.9% to 57.4 billion metric tons in 2013.

Finally, in the Middle East/North Africa region, steel demand has been growing very slowly due to “continuing political instability,” according to the forecasters. However, they anticipate that steel consumption in the region will increase by 4.9% in 2012 to a total of 62.7 billion metric tons, and that in 2013 it will increase a further 6.7% to 66.9 billion metric tons.

“Since the 2008 economic crisis, uncertainty and volatility has become the norm for the steel industry but it is worth noting that world steel demand has maintained positive growth despite all the headwinds and lingering difficulties,” World Steel’s Kerkhoff concluded.