Cutting Tool Orders Show Manufacturing is Steady

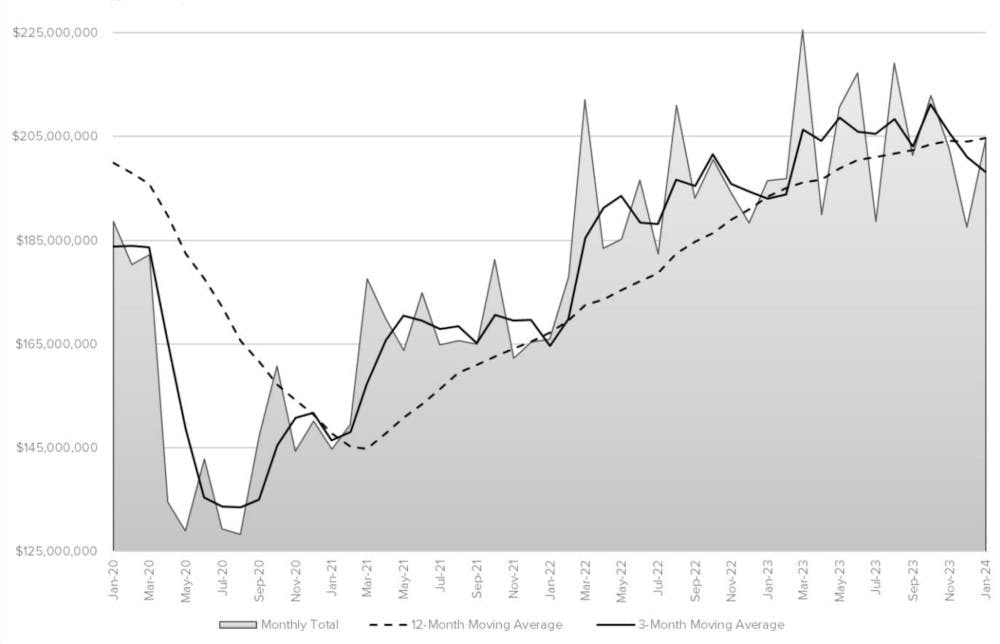

U.S. manufacturers ordered $204.5 million worth of cutting tools during January, 9.1% more than during December and 4.1% higher than the total for January 2023. The figures are supplied by the U.S. Cutting Tool Institute and AMT - the Assn. for Manufacturing Technology in the latest monthly Cutting Tool Market Report.

“January cutting tool shipments are a good start to 2024 and indicate that the expected decline will not be as severe as some fourth-quarter predictions that were based on the contraction in durable goods spending,” stated Jack Burley, chairman of AMT’s Cutting Tool Product Group.

Cutting-tool purchases are an indicator of overall manufacturing activity because those purchases reflect production across a range of manufacturing market segments served by machining operations. The data summarizes purchases by participating companies who comprise the majority of the U.S. market for cutting tools – whose customers are contract machine shops (job shops) and OEMs for whom cutting tools are significant consumable. Their demand for cutting tools closely matches U.S. durable goods shipments as a measure of production activity.

According to Kyocera SGS Precision Tool president Tom Haag: “January activity started quite slow after the holidays but appeared to recover as the month progressed and carried into February. We are hopeful that the inventory depletions at the close of 2023 are now being replenished to prepare for a solid manufacturing year in 2024.”

Haag cited the considerable order backlog in the commercial aerospace sector and automakers’ continuing efforts to support both EV and ICE vehicle production as sources of potential growth in cutting tool consumption.

The alternative case for growth is indicated by AMT’s recent U.S. Manufacturing Technology Orders report, which is an indicator of future manufacturing activity by job shops and OEMs. The low volumes of their orders suggests a lack of confidence in manufacturing demand growth.

“Job shops are reporting business activity, and quoting has slowed down some,” AMT’s Burley offered. “However, large original equipment manufacturers in automotive, truck, and aerospace are still investing in new production lines. Overall, there is optimism within the industry for continued growth this year.”