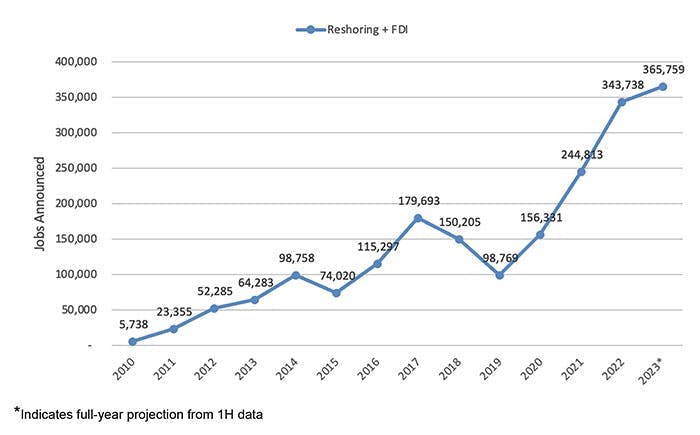

During the first half of 2023, nearly 300,0000 announced new U.S. jobs were attributable to businesses’ “reshoring” activity plus foreign direct investment, the Reshoring Initiative reported – in line with the record total of jobs reported for 2022 reshoring activity. According to the Reshoring Initiative, those new jobs will be predominantly the result new plants to manufacture electric-vehicle batteries and semiconductor chips, “along with other essential product industries supported by Bidenomics,” according to a release.

The group also identified “geopolitical risk” as a prompter for businesses’ to reevaluate their “supply chain priorities.”

“Reshoring” describes those actions taken by manufacturers to relocate production of raw materials and products to the U.S., to overcome supply-chain inefficiencies. Retired GF Machining Solutions president Harry Moser established the Reshoring Initiative in 2010 to track that trend, and “to move lost jobs back to the U.S.”

According to the Reshoring Initiative 1H2023 Report, current reshoring and foreign direct-investment job data demonstrate the how reshoring efforts have shaped U.S. manufacturing, after a cycle of “offshoring” that dates back several decades. “If this progress can be combined with an industrial policy that supports greater cost competitiveness, we will continue our rapid strengthening of U.S. supply chains,” according to RI.

There is no official definition of Bidenomics, though in a June speech the President authorized that term to describe the whole range of federal spending projects that the White House has claimed as the impetus for $500 billion in “manufacturing and clean energy investments” by businesses.

Principally, those using the term refer to the 2022 Chips Act ($280 billion over 10 years) to incentivize semiconductor manufacturing, R&D, and workforce development, and a further $24 billion worth of tax credits for semiconductor chip production. Bidenomics also would refer to the 2021 Infrastructure Investment and Jobs Act, which directed $1.2 trillion for transportation and infrastructure spending, including $550 billion prioritized for investments in new transportation- and clean-energy related projects and programs.

According to the RI summary, during 1Q 2023, average spending on U.S. factory construction was more than double the average from the past 17 years.

“Reshoring Initiative data parallels the magnitude and focus of the construction investments. Independently conducted surveys on reshoring actions by U.S. companies also correlate very closely with Reshoring Initiative data on jobs announced over the past 12 years,” the group stated.

“We publish this data to show companies that their peers are successfully reshoring and that they should reevaluate their sourcing and siting decisions,” according to Moser. “With 5 million manufacturing jobs still offshore, as measured by our $1.2 trillion/year goods trade deficit, there is potential for much more growth.”

Moser called for the Biden Administration and Congress to continue to promote reshoring activity, and “to enact policy changes to make the United States competitive again.”