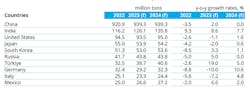

The World Steel Association updated its semiannual Short Range Outlook for steel demand, forecasting that global demand will grow +1.8% year-over-year for 2023, to 1.814 billion metric tons. This would follow the -3.3% decline in demand recorded for 2022. The target is slightly lower than the 2023 forecast that World Steel offered in April of this year (1.822 billion metric tons.)

The international trade association further forecasts steel demand will rise +1.9% year-over-year for 2024, to 1.849 billion metric tons – a figure that also is slightly lower than the total forecast in April (1.854 billion metric tons.)

Máximo Vedoya, Chairman of the World Steel Economics Committee, commented that global steel demand has been impacted by high inflation and high interest rates decreasing industrial and construction activities. “Since the second half of 2022, the activities of steel-using sectors have been cooling sharply, both for most sectors and regions, as both investment and consumption weakened. The situation continued into 2023, particularly affecting the EU and the U.S.

“Considering the delayed effect of the tightening monetary policy, we expect steel demand recovery in 2024 to be slow in the advanced economies,” according to Vedoya.Vedova said that steel demand in China will record “slight positive growth” in 2023 as the real-estate sector there stabilizes, thanks to government intervention. “The 2024 outlook for China remains uncertain depending on the policy directions to tackle the current economic difficulties,” Vedoya said, noting that the Chinese economy is undergoing “a structural transition phase that may add volatility and uncertainty.”

Regional conflicts in Russia and Ukraine, Israel and Palestine, and elsewhere, also represent uncertainty for steel demand, and could contribute to rising oil prices and further economic disruptions.

Steel demand in the U.S. has been affected by interest-rate increases, particularly from the residential construction sector, though commercial construction is showing some resistance to that trend – which the forecasters attribute to reshoring activities. U.S. steel demand is also benefitting from infrastructure investments.

However, the U.S. manufacturing sector has been slowing, except for automotive production, though those operations may begin to feel a lagging effect from high interest rates in 2024.

World Steel forecasts overall U.S. steel consumption to decline for a second straight year in 2023, down -1.1% from 2022, and before rising by +1.6% in 2024.