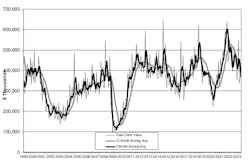

U.S. manufacturers’ new orders for machine tools increased rose to $411.3 million during June 2023, up 12.6% from May, but that result fell -1.7% from last year’s June result. More significant, the new figure brings U.S. machine tool orders to $2.44 billion for the first half of 2023, -12.7% lower than the January June 2022 total.

The figures are reported by AMT – the Association for Manufacturing Technology, which tracks orders for metal cutting and metal forming/fabricating machinery on a monthly basis for its U.S. Manufacturing Technology Orders report.

“Orders of manufacturing technology have continued their downward trend since peaking in the second half of 2021; however, for perspective, they remain above historical averages,” stated AMT president Douglas K. Woods. “Even in non-IMTS years, the majority of orders tend to come in the second half of the year. Despite some headwinds, including fears of a recession, it would seem reasonable that manufacturing technology orders could outperform some of the more pessimistic expectations if we return to that historical trend.”

AMT reported that job shops - the largest segment of the market for new machine tools - increased their investments by just 4.2% from May to June, and also reduced the number of new machine tools orders during the month. “Job shops tend to be smaller to medium-sized businesses, and the effects of economic uncertainty, coupled with higher interest rates, have begun to take a toll, causing some to delay capital investments,” according to Woods.

Half of the geographic regions – Southeast (-20.5%), South Central (-20.5%), and North Central-West (-8.0%) – recorded decreases in new-order value for June. The Northeast (+22.9%) and West (+7.2%) delivered positive order data for the month.One region, the North Central-East, reported a significant increase in machine tool orders - $74.62 million, or 61.1% more than the May total and 15.6% above the June 2022 total. The region’s year-to-date order total however is now $673.4 million, a -1.4% drop versus last year’s six-month total.

An increase of that scale may be the effect of “one bright spot,” according to AMT’s report: “… despite high interest rates and the ever-looming fear of a coming recession: Manufacturers of automotive transmissions have been noticeably increasing investment in manufacturing technology.”

YTD orders from the automotive transmission and powertrain parts sector are at the second-highest level since the first half of 2015, AMT noted.

According to Woods: “Investments on this scale show how manufacturers are preparing for a prolonged transitional period from internal combustion engines to electric vehicles. Moving toward electrification means facing numerous supply and logistical hurdles, from the sourcing of elements to grid reliability. Auto manufacturers recognize that until these challenges are overcome, demand for internal combustion engines will justify further investment.”