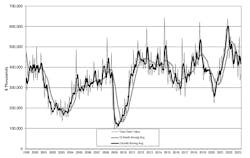

U.S. machine shops and other manufacturers increased their purchases by 10.0% from April to May, with new orders totaling $362.77 million in the most recent month. That figure falls -16.4% below the total posted for May 2022, however, and brings the current year-to-date total for new orders to $2.068 billion, or -14.6% lower than last year’s January-May result.

The data is drawn from the most recent U.S. Manufacturing Technology Orders report, issued by AMT – the Assn. for Manufacturing Technology. USMTO is a monthly summary of nationwide and regional demand for metal-cutting and metal-forming and -fabricating machinery. Those orders are a forward-looking indicator of overall manufacturing activity, as machine shops and other manufacturers make capital investments in preparation for demand expected in the weeks and months ahead.

“May orders increased but not enough to make up for the record decline we saw in April,” according to AMT president Douglas K. Woods. “Job shops increased orders at a slightly faster pace than the general market, but many large consumers of manufacturing technology decreased orders for the second month in a row. Significant growth from typically smaller consumers of manufacturing technology highlights some interesting changes in how and where goods are manufactured, particularly in anticipation of government spending programs.”As examples of smaller consumers, AMT cited new orders from electrical-equipment manufacturers, which hit a new high for 2023 during May, apparently as a consequence of efforts to address strains on U.S. electrical infrastructures. And more investments in that sector may be forthcoming, AMT noted, citing the 2021 Infrastructure Act.

Construction is another sector exhibiting growing demand for more manufacturing technology. “Construction machinery manufacturers doubled their order volume over April 2023, putting them on pace for the highest order volume since 2012, and hardware, screw, nut, and bolt manufacturers significantly increased orders in May,” according to the USMTO release. MT investments in the construction sector are indicative of increasing demand for new residential construction.

Construction spending on new manufacturing facilities is also rising, AMT noted, doubled in fact since the end of 2021.

The best of the regional results for May came from the North Central-East, where new orders for metal-cutting machinery totaled $77.87 million – and yet that represents a-6.4% decrease from the April total, and a -41.5% drop from May 2022. For the current year to-date, the North Central-East region has logged $556.65 million worth of new orders, which is -4.4% lower than the comparable figure for 2022.

Other regions posting strong May results were the Northeast ($66.31 million), North Central-West ($65.66 million), and West ($63.74 million.)

The Southeast region posted $52.21 million worth of new orders for metal-cutting machinery during May, which is 35.7% more than the result for April and 11.0% more than the May 2022 total.

The South Central region’s $41.98 million worth of new orders for metal-cutting machinery was unchanged (0.2%) from April, but 40.9% better than the May 2022 result.

“Despite the positive news for the general economy, such as the upward revision to Q1 GDP two weeks ago and continued employment strength, the manufacturing technology industry is showing signs of a slowdown,” Woods commented.

“Our experience in 2016 shows that it is possible for there to be a downturn in the manufacturing technology industry while avoiding a broader recession,” he continued. “Only time and more data will tell if we are in an economic situation more like 2016 than the situation in 2001, as many economists have predicted.”