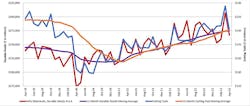

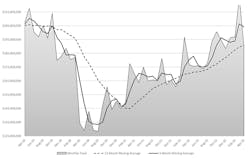

Machine shops and other manufacturing operations reduced their cutting-tool purchases by -15.8% from March to $190.0 million in April, though that total still represents a 7.5% improvement over last April’s total. While cutting-tool demand made a marked increase during the January-March period, Q2 demand has returned to the pace observed at the start of this year.

“Demand from durable goods manufacturers has supported shipments over the past year but is now expected to turn weaker in coming months, in line with expectations for a shallow recession,” explained economist Mark Killion, director of U.S. industries at Oxford Economics.Data from the monthly Cutting Tool Market Report shows 2023 year-to-date cutting-tool consumption totals $809.0 million, a 15.2% improvement over January-April 2022.

Cutting-tool consumption is an indicator of overall manufacturing activity because those purchases reflect activity across a range of manufacturing market segments served by machining operations.

While several industry market segments have contracted recently, cutting-tool market indicators remain positive with anticipated mid-single digit growth for 2023,” according to Jeff Major, president of the U.S. Cutting Tool Institute, which presents the monthly CTMR jointly with AMT – the Assn. for Manufacturing Technology. “There is a consensus that cutting-tool inventories are higher within the distribution segment, which may indicate a short-term inventory burn followed by a possible uptick in renewed buying.” CTMR data is based on totals reported by participating companies and represents the majority of the U.S. market for cutting tools.