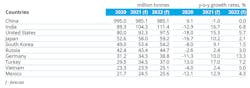

The World Steel Association revised downward its semi-annual Short Range Outlook for global steel demand, pegging 2021 demand to rise 4.5% to 1.85 billion metric tons – still an improvement after the negligible increase (0.1%) for 2020. The 2022 demand level is now seen rising by 2.2% to 1.89 billion metric tons. In its previous Short Range Outlook, in April 2021, World Steel forecast that global steel demand would rise 5.8% this year to 1.87 billion metric tons, then a further 2.7% to 1.92 billion metric tons in 2022.

The trade association representing steelmaking businesses in 64 countries stipulated that its outlook assumes Covid-19 vaccination rates will continue to increase worldwide and that any spread of new variants of the virus “will be less damaging and disruptive than seen in previous waves.”

Saeed Al Remeithi, chairman of the World SteelEconomics Committee, stated: “2021 has seen a stronger than expected recovery in steel demand, leading to upward revisions in our forecast across the board except for China. Due to this vigorous recovery, global steel demand outside China is expected to return earlier than expected to its pre-pandemic level this year.”The decrease in Chinese consumption is consequential for the global forecast, as China currently accounts for about two-thirds of all steel manufactured worldwide. World Steel confirmed that the nation’s steel consumption has been decelerating in recent months, -13.3% in July and -18.3% in August. It cited tighter government restrictions on real-estate and infrastructure projects, as well as a government cap on steel production, for these decreases.

World Steel predicted that “Chinese steel demand will have negative growth for the rest of 2021. As a result, while the January-to-August apparent steel use still stands at a positive 2.7%, overall steel demand is expected to decline by -1.0% in 2021.”

Furthermore, no growth in Chinese steel demand is expected during 2022, as real-estate development will remain limited by government policies.

World Steel forecasts that the U.S. economic recovery will continue through 2022, with steel demand paced by automotive and durable-goods manufacturing. U.S. construction-sector demand is weakening however, with little improvement in residential construction and sluggish activity in non-residential construction. Rising oil prices are driving new investment in energy markets, however.

In its forecast for demand according to market application, World Steel noted that the construction sector has been more resilient than manufacturing since the pandemic shock. However, in many developing economies, construction activity was severely disrupted by a total stoppage of projects. For 2021, World Steel forecasts global construction to demonstrate a strong recovery driven by low interest rates and governments focusing on infrastructure projects as part of their recovery plans.

After a sharp downturn due to lockdowns, the global automotive industry recovered in the second half of 2020. “Although supply chain disruption is still evident in some markets, the recovery is driven by pent-up demand and increased household savings,” the group noted.