VDW Forecasts Revival in Machine Tool Demand

The German Machine Tool Builders' Association (VDW) issued an economic forecast for 2021, predicting that its members’ collective revenue will grow 6% year-over-year in 2021, to €12.6 billion ($15.2 billion), identifying “an improved mood in the economy is raising the willingness to invest.” The growth in machine-tool demand will be underpinned by a forecast 5.0% increase in global economic activity.

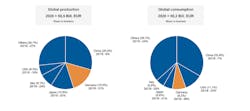

German machine-tool builders comprise one of the largest national groups in the global manufacturing technology industry, and one of the top-five specialty groups in the mechanical engineering sector. In 2020, VDW member companies produced machines and services worth around €11.8 billion ($14.4 billion.)

"After two years of great restraint, there is now a strong need to make up ground," according to VDW chairman Dr. Heinz-Jürgen Prokop. "However, the prerequisites for companies' regaining their confidence and investing are beating the corona pandemic and sketching out a sensible roadmap for gradually emerging from lockdown."In 2020, VDW member companies’ orders fell by 30% year-over-year (due to the Covid-19 pandemic), with a comparable year-over-year decrease in 2019. Also in 2020, VDW members’ production volumes decreased -31% year-over-year, export sales fell 29%, and domestic sales dropped 33%.

Furthermore, while VDW members’ capacity utilization for 2019 hit 88%, but the 2020 decline in orders brought capacity utilization last year to 72% - comparable to the 2009 level.

As for its 2021 outlook, VDW sees the automotive industry benefiting economic expansion in China. Electronics, food processing, logistics, and parts of the medical technology sector also appear to have sustained growth prospects.

In Europe, capital investments are seen rising by 10% in 2021 year-over-year, with two years of pent-up demand having a positive effect on the machine tool industry: VDW cited its forecasting partner Oxford Economics predicting a 35% increase in machine-tool orders in 2021.

As for exports, China is the world’s largest market for machine tool sales, estimated to total €18 billion ($21.7 billion) for 2021, and the largest market for machine-tool imports (€5.4 billion / $6.5 billion.) "Companies are already reporting strong pressure on prices and deadlines from Chinese clients," according to Prokop, citing the In addition, the recently concluded Regional Comprehensive Economic Partnership (a free-trade agreement among the Asia-Pacific nations) which is seen advantaging Japanese and South Korean machine tool manufacturers. He also noted that the Chinese government is working to reduce its reliance on technology imports.

Noting that experts contend it will not be technically possible to achieve zero emissions in internal combustion engines by 2025, or only at very high cost, Prokop said modern combustion engines will be necessary to achieve climate targets in the medium term, and vehicles that adopt hydrogen-based e-fuels can help achieve major reductions in emissions.

"An abrupt end to the combustion engine would slam the brakes on technical progress because Euro 7 would kill all further investment in engine development," explained Prokop.

The VDW concluded by calling for EU manufacturers to join in “a technology offensive in favor of environmentally friendly mobility.

“The aim is for the organisations to work together with industry to achieve climate neutrality, and to draw upon the strengths of companies in developing new technologies. For this reason, many different technologies should be deployed to reduce exhaust gas and CO2 emissions. In the future, this will include the use of hydrogen and synthetic fuels in vehicles, and also further optimisation of the combustion engine, the use of fuel cell technology and a growing number of battery-powered vehicles. "Relying solely on electromobility would lead to an extreme increase in electricity demand, which could not currently be covered by renewable energy," said Prokop.