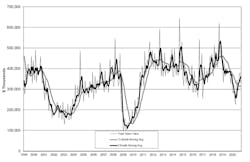

Domestic machine shops and other manufacturers ordered $330.3 million worth of new machine tools during November 2020, a -13.3% drop from the October order volume, and slightly higher (+1.4%) more than the November 2019 order volume. The year-over-year increase for November was the first such result for the U.S. Manufacturing Orders report, as noted by AMT – the Assn. for Manufacturing Technology, which issue presents the monthly summary of new orders for metal-cutting and metal-forming and fabricating machines.

Through 11 months, U.S manufacturing technology new orders totaled $3.4 billion, -18.7% less than the January-November 2019 order total.

While machine tool new orders had been weakening during the latter months of 2019, a demand recovery had been forecast for late 2020, prior to the onset of the COVID-19 pandemic.

“Given the dire predictions about economic contraction in the manufacturing sector at the beginning of the pandemic, an -18.7% contraction in growth YTD, with only one month to go, makes clear that the sector did not fare as poorly as originally predicted,” commented AMT president Douglas K. Woods. “The share of total orders from job shops increased in November. This could be due to larger manufacturers and OEMs delaying investments in capital equipment until 2021 when they can expense these investments against expected higher tax rates.”

AMT’s USMTO report is a forward-looking index to manufacturing activity, tracking manufacturers’ capital investments in anticipation of future work orders. It contains actual figures for new orders of metal-cutting and metal-forming and -fabricating equipment, nationwide and in six geographic sectors, based on information supplied by participating producers and distributors of that equipment.

The USMTO regional summary for November new orders showed strength in the North Central-West (+12.4% over October, +56.2% over November 2019) and South Central (+26.8%, +8.6%; moderation in the Northeast (-2.9%, +4.0%.)

More weakness was evident in orders for metal-cutting machines in the North Central-East (-40.6% from October, -1.4% from November 2019), Southeast (-12.9%, -10.9%), and West (-19.1%, -25.3%.)

“Despite overall positive momentum in the past several months, December is not expected to be quite as strong as November for several reasons,” according to Woods. “Many facilities closed earlier or for longer than usual for the holidays because of supply-chain related delays, COVID-related staff shortages, and to regroup for 2021 after an overall challenging year.”

He went on to forecast that new orders will pick up in January, but the growth is likely to be inconsistent as economic demand faces continuing workforce disruptions due to “quarantines and restrictions, imported components supply-chain issues, and overloaded rigging and freight providers.

“As we move forward in 2021, disruptions will become less severe and order levels will more closely resemble 2019 activity,” Woods offered.