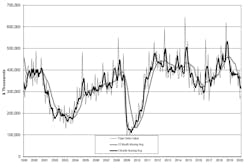

U.S. manufacturers ordered $277.9 million worth of new capital equipment during February, a 2.8% rise over January orders but -17.0% less than February 2019 total. While the February total showed a month-to-month improvement, the actual result was lower than any single monthly total in the past year.

Through the first two months of 2020 new machine tool orders have totaled $546.95 million, -26.2% behind the January-February 2019 result. The president of AMT-the Assn. for Manufacturing Technology said the forecast recovery of the machine tool market is likely to take a long time, as the global and national economies regain their pre-Coronavirus crisis levels, and manufacturers achieve new growth momentum.

“Before the pandemic hit we had predicted lower manufacturing technology orders in the first half of the year with a pickup in the second half,” stated Douglas K. Woods, president of AMT – the Assn. for Manufacturing Technology, which supplied the orders summary in its latest U.S. Manufacturing Technology Orders report. “Clearly the downturn will be much more severe than could have been anticipated."

The USMTO report a monthly series that tracks new orders for machine tools and related products nationwide and in six geographic sectors. AMT issues USMTO as a leading indicator of manufacturing industry demand. Manufacturers' investments are indicative of planned and/or anticipated production programs. The report includes nationwide and regional data for orders of metal-cutting and metal-forming and -fabricating equipment, based on information supplied by participating producers and distributors of that equipment.

The February regional orders summaries showed some strength in the Southeast (up 23.8% in February over February 2019) and the West (up 29.1% over February 2019), but down -46.8% year-over-year in the North Central-West.

Woods observed that the onset of the COVID-19 pandemic and the disruption to business undertaken to help control the spread of the virus is affecting manufacturers as work orders are canceled or postponed. He added, however, the "due to long lead-times of some industrial equipment and urgent retooling to meet crisis-related production, some pockets of investment are continuing."

AMT's top executive opined that the pandemic has exposed "the risks of excessive reliance on non-diversified, global supply chains to produce the necessary products and equipment in a time of crisis … Revitalizing America’s manufacturing sector would provide the U.S. with “self-manufacturing-sufficient” supply chains to support our industrial base in a crisis.”

“While we still expect a rebound later this year, this recovery is likely to take an extended period of time to get to pre-crisis levels as the global economy, the U.S. economy, and the manufacturing industry slowly regain their momentum,” Woods offered.