January Machine Tool Orders Down, Recovery Uncertain

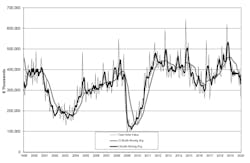

Machine shops' and other U.S. manufacturer's new orders of capital equipment fell to $269 million, down -32% from December 2019 and down -34% from the total for January 2019. “Based on our economic forecasts, we projected that the beginning of 2020 was going to be challenging for manufacturers, and indications were that growth would resume mid-year," according to Douglas K. Woods, president of AMT-the Assn. for Manufacturing Technology.

More recent developments cast a shadow on the outlook, however. Woods predicted that the coronavirus outbreak is likely to impact a turnaround in manufacturing technology on several fronts, including global travel and commerce, supply-chain disruptions in Asia, and purchasing decisions delayed due to uncertainty. He cautioned that the economic downturn could several months, as has happened in earlier disease outbreaks.

Despite the current decline, Woods identified some "bright spots" in the economic conditions shaping the manufacturing, including a January increase in the Institute for Supply Management's Purchasing Managers Index (PMI) index, indicating a return to an expansionary rather than a recessionary trend; and he cited the American Banking Assn.'s Consumer Sentiment Index's increase from 99.3% to 99.8%. Housing starts were also positive, up 21.4% over last January and at a higher level than average for the past ten years. He further noted new housing starts improved 21.4% over January 2019, "and at a higher level than average for the past 10 years. "These data all indicate that the fundamentals of the U.S. economy are strong, and this should aid in a quick recovery,” Woods assured.

The regional results for the January USMTO report show that new orders for metal-cutting equipment in the Northeast region totaled $45.59 million, -49.4% less than in December and -41.1% less than in January 2019. In the Southeast region, manufacturing technology orders totaled $29.62 million in January, -34.3% less than in December and -52.6% than in January 2019. The North Central-East region reported $60.79 million worth of new orders in January, down -25.5% from December and -31.0% from January 2019.

January new orders in the North Central-West region were reported to be $65.89 million, -20.2% from December and -9.5% from the January 2019 result.

In the South Central region, new orders for metal-cutting equipment totaled $24.69 million, down -26.5% from December and -29.9% from January 2019.

The West region's January new orders totaled $60.71 million, down just -4.2% from December but -25.4% from January 2019.