Machine Tool Orders Making a Second-Half Rebound

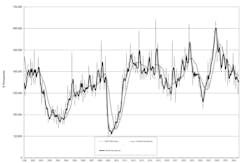

U.S. manufacturers’ new orders for machine tools improved to $360.8 million in August, up 22.7% from July but still -12.0% behind the August 2023 new-order volume. The latest result brings the eight-month value for U.S. machine tool orders to $2.86 billion, -11.5% less than the January-August 2023 order total.

The totals are supplied by AMT - the Assn. for Manufacturing Technology in its monthly U.S. Manufacturing Technology Orders report, which tracks purchases of new metal-cutting machinery and metal-forming and fabricating machinery nationwide and in six regions, as an indicator demand for that capital equipment. USMTO also serves as an indicator of future manufacturing activity because it quantifies machining operations’ investments in preparation for new production programs.

AMT noted that the latest results show that new-order activity remains “above historic levels” for August, and concluded that this trend shows that the manufacturing-technology industry “is still undergoing a period of normalization following the COVID disruptions rather than a true decline. Historically elevated capacity utilization rates across durable goods manufacturers indicate a very real need for additional investment in manufacturing technology.”

AMT noted that contract machine shops (i.e., “job shops”), which represent the largest cohort of machine tool buyers, increased both the number and value of machines ordered for the first time since March. “Since job shops typically absorb elevated capacity needs from OEMs, this buying trend indicates that production could continue to grow,” according to the association.

Shops supplying the aerospace sector increased the value of their August orders by 13% from July, and the number of units ordered rose nearly 27% during the month, AMT noted. “This indicates their purchases are for additional capacity, which is confirmed by the persistently increasing capacity utilization rates in the sector,” it explained.

AMT observed that the ongoing strike by Boeing workers (which began on September 13) ultimately may have some effect on orders for the manufacturers in that sector, but it added that aerospace OEMs are in possession of very full order books and have posted rising capacity utilization rates. Any negative effects of the strike on aerospace suppliers’ machine tool orders is difficult to foresee.

The USMTO’s regional results for metal-cutting machines during August were particularly strong in the Southeast (+56.2% over July), South Central (+38.3%), West (+37.7%), and North Central-West (+25.3%). The Northeast region also improved (+15.1%) for the month, while the North-Central East region reported a -2.0% month-to-month drop in new orders for metal-cutting machines.

The AMT put a positive outlook on the USMTO orders for the remainder of 2024, with September results due to include orders placed in connection with IMTS 2024, plus a pending reduction in interest rates and expiration of bonus depreciation for capital investment likely to encourage capital likely to drive manufacturers’ decisions to acquire new machinery during the fourth quarter.