Machine Tool Orders Rising at Midyear

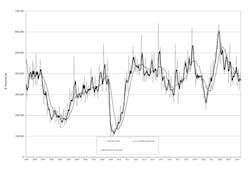

U.S. machine shops and other manufacturers increased their orders for new capital equipment in June, up to $402.3 million, or 4.3% more than the May order level. But the new total lags the June 2023 order volume by -1.6%, and while it brings the year-to-date order volume to $2.2 billion, that figure trails the comparable January-June 2023 total by -10.7%.

The data is provided by AMT - the Assn. for Manufacturing Technology in its latest U.S. Manufacturing Technology Orders report, a monthly review of new orders for machine tools (i.e., “manufacturing technology”), that serves as an indicator of future manufacturing activity because it quantifies machining operations’ investments in preparation for new production programs.

AMT’s report compiles data for metal-cutting and metal-forming-and-fabricating machinery, nationwide and in six regions of the U.S.

Although the total value for manufacturing orders in the first half of this year remains well behind 2023, AMT noted that the difference has narrowed in recent months.

But the Association also pointed to another trend: “While the value of orders maintained momentum in June 2024, with the average value increasing significantly, the number of units ordered for the month dropped to 1,471 units, the lowest since July 2023,” according to AMT. And it pointed to evidence that machine tool prices (according to the producer price index) has remained stable in recent months – meaning the higher USMTO value is based on fewer machines being ordered overall.

AMT observed that the divergence between the order value and the unit total indicates “manufacturers are generally investing in more automated, task-specific solutions.”

As for the drop in total units ordered, the largest segment of the market for new manufacturing technology is contract machine shops, aka “job shops,” and those operations’ June 2024 orders fell more than 10% from May, in both order value and total units. For the January-June 2024 period, contract machine shops’ new-order value was the lowest first-half total since 2020 – but the number of units ordered during the recent period fell to the lowest level since January-June 2010.

Alternatively, aerospace machine shops’ first-half 2024 orders increased to their highest level since the comparable period of 2018, even though the value of orders is about -2.0% less than orders placed during January-June 2022.

The June USMTO report showed particularly strong demand in the Southeast region, where new orders for metal-cutting equipment totaled $56.56 million, up 48.1% from May and up 38.8% from June 2023. For the year-to-date, the region’s new orders for metal-cutting equipment are up 12.3%, or $306.92 million through June.

Only the North Central-West (+12.4% from May; +37.5% from June 2023) and West (+0.1%; +4.6%) posted positive new-order totals for metal-cutting equipment during June, and the West region also moved into positive territory for the year-to-date, up +9.6% from January-June 2023.