Rise in Machine Tool Orders Counters Trend

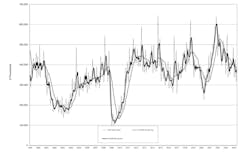

U.S. machine shops and other manufacturers increased their demand for capital equipment during May, with new metal-cutting and metal-forming and fabricating machines rising 21.8% from April to $386.7 million for the month. That represents a 6.5% increase in new orders from May 2023, but it brings the 2024 year-to-date new-order volume to $1.813 billion, which is -12.2% less than the January-May 2023 new-order volume.

These figures are supplied by AMT - the Assn. for Manufacturing Technology in its U.S. Manufacturing Technology Orders report, a monthly review of new orders for machine tools (i.e., “manufacturing technology”), that serves as an indicator of future manufacturing activity because it quantifies machining operations’ investments in preparation for new production programs.

AMT’s report compiles data for metal-cutting and metal-forming-and-fabricating machinery, nationwide and in six regions of the U.S.

The Association noted that the May USMTO total indicates a realization by manufacturers that capital investment is necessary “to meet the sustained demand for goods and machinery from consumers and businesses,” in spite of the ongoing strain of high interest rates that have weighed against new-order activity since January.

As proof of that conclusion, AMT reported that contract machine shops (or “job shops”) increased their order volumes during May. Although those shops are the largest segment of the market for new manufacturing technology orders, they have consistently trailed the overall market during the first five months of 2024.

Demand for manufacturing technology among OEM is notably strong among electrical equipment manufacturers and power-generation and transmission equipment manufacturers.

“These industries undoubtedly benefit from the government investment authorized by the CHIPS and Infrastructure acts and are therefore less sensitive to interest rates than others,” AMT observed.

Automotive manufacturing continues to be another important source of manufacturing technology demand during May was the automotive industry, though not at the solid pace that was typical during 2022-23.

Regional demand for manufacturing technology was generally strong during May, particularly in the Northeast where orders for metal-cutting machinery rose 73.3% from April to $77.08 million, which is up 17.4% year-over-year, and yet the regional YTD order total of $287.9 million still lags 2023 by -15.2%.

Strong May order volumes were also reported for the North Central-East, South Central, and North Central-West regions, and less so but still positive in the West region – though the YTD activity is still trailing last year’s results.