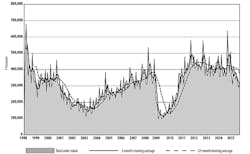

New orders for machine tools rose to $321.77 million during September, a rise of 10.9% from August, but still 49.6% lower than the September 2014 total – an exceptionally strong period that coincided with the staging of IMTS 2014. Even so, the latest monthly result will be seen as an encouraging rebound after two months of falling order totals.

“Considering the growth in orders we’ve seen over the past two years, this decline is not as bad as it sounds,” commented AMT president Douglas K. Woods. “It’s important to remember that 2014 was a record-setting year, and that some leveling off to minor pull backs are expected.”

The data on machine tool orders is drawn from drawn from the U.S. Manufacturing Technology Orders Report, issued each month by AMT – the Association for Manufacturing Technology. The USMTO is based on actual data provided by participating companies who produce and distribute metal cutting and metal-forming and –fabricating equipment, including domestically manufactured and imported equipment.

Through the first nine months of 2015, new orders for machine tools total $3.1 billion, or 16.6% less than the total for the comparable period of 2014.

In its announcement, AMT listed energy costs, a stronger dollar, and a generally weak global economy as factors discouraging capital investment by manufacturers. But, it also noted there also factors that should give businesses and investors confidence in the current economic improvement. Among these, it listed a continued expansion of manufacturing activity (77 consecutive months through October 2015, as measured by the Institute for Supply Management), a narrowing U.S. trade deficit; and a new two-year federal budget agreement, reached in October.

In any case, the improvement in new orders was not felt evenly across the six regions measured each month for the USMTO report. In the Northeast region, new orders for metal cutting equipment rose 9.0% from August to $54.94 million, but that total is less than half (-50.9%) of the September 2014 order volume. Still, the region’s year-to-date total for overall machine tool orders is only barely less (-0.8%) than the January-September 2014 result.

In the Southeast, manufacturers ordered $47.17 million, a total that is 23.7% more than the figure reported in August, but 33.6% less than the September 2014 total. For the year-to-date, the Southeast region lags its 2014 pace by 6.1%.

In the North Central-East region, September new orders rose 22.1% from August to $98.88 million. That figure was still 26.3% less than the September 2014 order total, and the region’s nine-month total is off the year-ago pace by 12.0%

The North Central-West region reported new orders totaling $50.79 million for September, a result that is 11.5% less than the total reported for August, and 160.9% lower than the September 2014 figure. For the current year, the region’s cumulative new order total is 8.9% behind the total for January-September 2014.

The South-Central region’ new orders for metal cutting equipment totaled $13.01 million during September, 4.0% more than the August total but 86.7% less than the September 2014. The region’s total orders for 2015 now stand at $240.51 million – or 58.8% less than the comparable nine-month result for 2014.

In the West region, new orders for metal cutting equipment totaled $48.96 million, an 11.0% increase over the August report, but a 46.7% decline from the September result. For the current year-to-date, Western regional new orders stand at $477.20 million, or 13.2% less than last year’s nine-month total.

“Our forecasters predict this market softness will last at least through the first quarter of 2016, but it could turn around sooner rather than later. Right now, economic indicators are favorable and several of our members’ key customer segments are strong. Autos, medical equipment and aerospace are all doing exceptionally well. That should help boost capital investment,” Woods said. “Overall, we are looking positively at 2016, as we anticipate an upturn in time for IMTS.”