Machine tool builders in two of Europe’s largest manufacturing markets reported rising orders during the third quarter, with orders from domestic buyers providing especially encouraging results. Reports by the machine tool builders’ trade associations in Germany (VDW) and Italy (UCIMU) were a notable contrast to the weakening order volumes in the U.S. machine tool sector.

During the third quarter of 2015, the German machine tool industry’s new order volume fell by 1% compared to the Q3 2014 reports. Machine tool orders from domestic (German) buyers rose by 9%, VDW reported, while demand from outside the country was down 7%, year-on-year.

Even so, during the January-September period new orders remained flat compared to first nine months of last year: domestic orders were down 3%; orders for exports were up 1%.

“In the year’s third quarter, our sector was boosted by orders from Germany itself and from the Eurozone,” stated Dr. Wilfried Schäfer, VDW executive director.

The regional results showed Western European demand to be the most rewarding for the German machine tool industry. Orders from North and South America, by contrast, were down compared to 2014, and new orders from Asia delivered modest growth. Even though orders from China were down, good results with South Korea and Japan moderated that effect for the VDW members.

During the January-September 2015 period, VDW members’ net revenues rose by 2%, and the agency expressed assurances that full-year result for 2015 will be comparable (though this alters the outlook issued by the group in January.)

“Back then, we were forecasting growth of 3%,” recalled VDW executive director Wilfried Schäfer. “In a comparatively cyclical sector like the machine tool industry, however, forecast fluctuations of one percent are not so uncommon.

“Nonetheless, with a result of what would then be around €14.8 billion, we’re up at our best level,” Schäfer concluded.

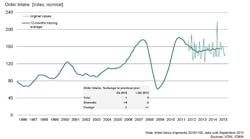

Italian machine tool builders reported a 16.3% increase for the third quarter of 2015, compared to Q3 2014. The economic research division of UCIMU-sistemi per produrre, the Italian trade association for manufacturing machinery and automation reported those results. It marked the eighth consecutive quarter of rising new orders volumes for the Italian machine tool industry, on the strength of both domestic and foreign demand.

UCIMU noted that domestic (Italian) orders grew by 5% over the July-September 2014 period; orders from foreign (non-Italian) customers increased by 18.5%.

Luigi Galdabini, UCIMU president, said “This last survey has confirmed that the Italian industry of the sector has taken a favorable path, proving to be able to seize the opportunities offered by the recovery of Italian and foreign demand.”

Galdabini said the positive trend in new orders volume, as well as the success recently of the EMO Milano 2015 trade show for manufacturing technology, confirms the sturdiness of the current demand for mc of this trend. With over 155,000 visits from 120 countries and 120,000 square meters of net exhibition area, EMO MILANO 2015 will be remembered as a record-breaking edition, also for the inclination to invest shown by visitors.”

Galdabini said Italian legislators and regulators should solidify the strength of demand in the market by extending special tax incentives for new equipment orders.

“The displayed technology suggests our government authorities that the intentions of Italian users should be supported by special ‘ad hoc’ actions, since they are again ready to purchase new production means, as foreign users are,” he said.