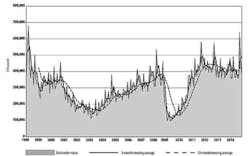

Machine shops and other domestic manufacturers ordered $378.06 million worth of machine tools and related technology during November 2014, a -15.5% decline from October’s revised total of $447.14 million, and the second consecutive monthly decline since the impressive September results.

The data is based on the latest U.S. Manufacturing Technology Orders report issued by AMT – the Association for Manufacturing Technology, a monthly summary of new orders for machine tools and related technology, based on actual data reported by participating manufacturers and distributors. It covers both domestically sourced and imported metal-cutting equipment and metal forming and fabricating equipment.

The November figures also represents -14.5% decline over the November 2013 order total, $442.01 million. However, at $4.56 billion through November, the 11-month total for 2014 is a 2.6% improvement over the previous year’s comparable result.

“Despite a downward monthly trend in manufacturing technology orders, we remain bullish on the U.S. industry market overall, with robust factory production and strong performance in the automotive sector,” stated Douglas K. Woods, AMT President.

“Many manufacturers took a ‘pause’ in November to assess the challenges from the previous few months,” he elaborated, “such as contraction in China, Europe and Russia, less activity from the oil and gas industry due to the dramatic drop in prices and perhaps a little bit of the ‘IMTS Effect’ pulling some sales forward. Overall, however, we anticipate 2015 to be another year of positive growth, with manufacturing leading the U.S. economy.”

Woods was describing the extraordinary USMTO figures for September 2014, orders that coincided with the biennial trade show for machines and machining technology.

The USMTO report documents orders for metal cutting equipment and metal forming and fabricating equipment in six geographic regions, at least one of which delivered positive results for machine tool suppliers and distributors in November. However, because AMT revised its geographic references in the past year, and the reporting accounts for changes in the survey participants, the association notes that comparisons for Metal Forming and Fabricating equipment orders are not an accurate reflection of the current data. AMT further explained that data is adjusted to reflect this change, but some categories remain unreported.

In the Northeast region, metal-cutting equipment orders totaled $41.86 million, -28.3% from October and -43.8% from November 2013. The region’s year-to-date total for metal-cutting equipment through November was $694.63 million, -3.6% versus the January-November total for the previous year.

The Southeast regional totals proved encouraging for machine tools, as total new orders (metal cutting equipment, metal forming and fabricating equipment) increased 37.7% for the month to $48.66 million. That total brings the region’s year-to-date new orders to $439.88 million, 8.1% higher than the previous’ year’s result.

In the North Central-East region, total new orders for manufacturing technology declined in November to $94.07 million, down -20.7% from October and down -24.6% from November 2013. The region’s 11-month total for 2014 is $1.2 billion, 4.3% higher than the 2013 total at the same time.

In the North Central-West region, the latest month’s orders fell to $68.29 million, down -27.1% from October. The 2014 year-to-date total in the region is $802.81 million, -2.5% less than January-November total for 2013.

The South Central region recorded $63.20 million of new orders during November, and though the data is insufficient to compare the result to October’s orders, the new figure is -3.4% down from November 2013’s result. The year-to-date total, $714.15 million, is 5.9% above the region’s 11-month figure for 2013.

Last, the West region reported metal cutting equipment orders of $60.97 million during November, a -14.3% change from October, but Just -1.0% less than the November 2013 results. The region’s year-to-date total for metal cutting equipment was up 5.9% compared to the same figure for the previous year.