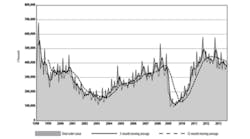

Chinese demand for new machine tools is forecast to increase 9.2%annually over the next for years, rising to 600 billion yuan ($98.6 billion) in 2017. That is the conclusion of a new market analysis report available from The Freedonia Group Inc.

Freedonia’s Beijing-based analyst Linda Li reported that the increases in the Chinese market demand would be driven by steady expansion in the country’s industrial machinery and transportation equipment industries. An ongoing shift toward higher-value machines will help to raise the overall value of machines that are supplied there — meaning, for example, machines with more advanced CNC controls and multitasking machine tools.

According to Linda Li, “increasing regulations regarding energy conservation will lead to growth in demand for energy-efficient machine tools.”

The study concludes that China’s trade deficit in machine tools will continue to increase for the foreseeable future. Imports will rise to ¥184 billion ($30.25 billion) in 2017, which will benefit foreign suppliers as demand increases for the varieties and special capabilities of machine tools desired (and required) by Chinese manufacturers.

Decreases in tariffs on imports through 2017 also will promote sales of imported products.

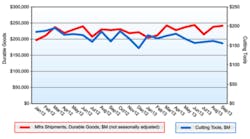

Among categories of machine tools, metal cutting equipment will continue to be the largest product segment in 2017. This will be the result of “relatively wider range of applications in durable goods production and a comparatively greater variety of metal cutting product types,” according to the Freedonia study.

Growing demand for machines with more advanced metal-cutting capabilities (again, CNC controls and multitasking capabilities) will boost sales in this category.

Chinese demand for metal forming equipment is predicted to advance 9.7% annually through 2017, following the increased production anticipated in that country’s motor vehicle, shipbuilding, aerospace, and power transmission and distribution markets.

Other Chinese sectors driving demand for new machine tools will include industrial machinery and transportation equipment. Freedonia noted that these two sectors were the most important factors defining the current market, accounting for more than 60% of Chinese demand for machine tools in 2012.

Through 2017, the industrial machinery and transportation equipment sectors will have demand growth near the market average, according to Freedonia. This is based on expectations of continuing expansion in durable goods production, facility renovations, and new product innovation in all Chinese markets, stimulating growth.

Machine tool demand in the electrical and electronics market is expected to increase near the average rate through 2017, thanks to increases in steady investment in the home appliance and power generating equipment industries.

Demand for machine tools in China’s primary and fabricated metal markets will benefit from ongoing investment in new construction projects, the study noted.