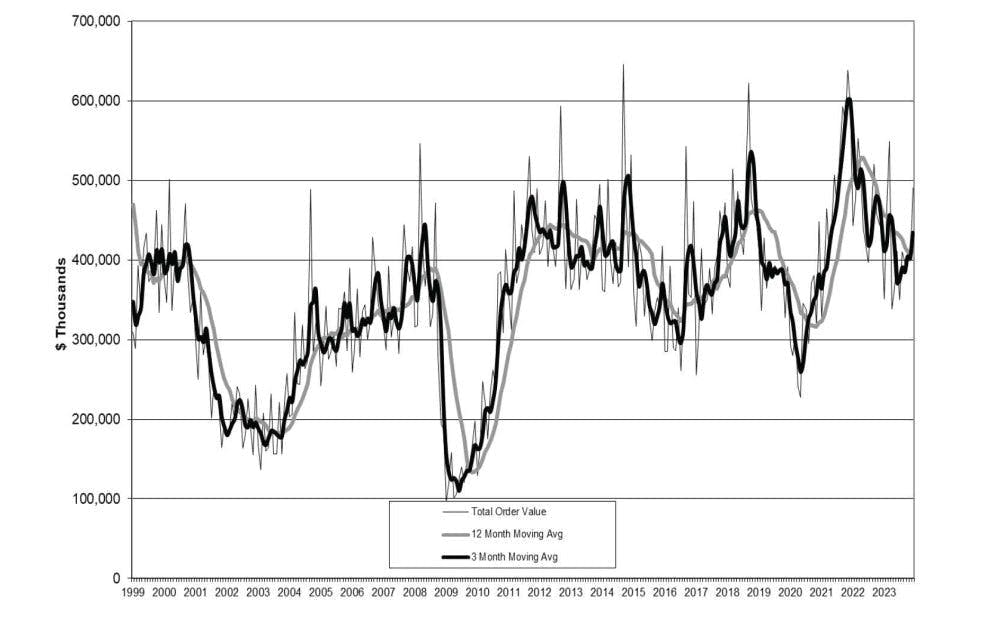

New orders for machine tools took a surprising, positive turn during December as manufacturers purchased $491.03 million worth of metal-cutting and metal-forming/fabricating machinery. The result was a 21.7% improvement over November, and an 11.9% increase over the December 2022 total, in the U.S. Manufacturing Technology Orders report issued by AMT - the Assn. for Manufacturing Technology.

AMT’s USMTO program tracks new orders of machine tools as an indicator of future manufacturing activity, as machining operations prepare to undertake new production programs. The monthly update tracks orders for metal-cutting and metal-forming-and-fabricating machinery, nationwide and in six regions of the U.S.

The December USMTO results drove the full-year total for machine tool orders to $4.94 billion, -11.2% lower than the 2022 total.

According to AMT, the 12-month total “surpassed many predictions.” The association offered various indicators that explained the overall decline in machine-tool bookings during 2023. For example, contract machine shops (small/medium-sized businesses, the largest segment of machine-tool buyers) reduced their orders slightly more than 21%, year-over-year. Even so, the overall decline in new orders was not as severe as some early predictions due to new orders from larger manufacturers and OEMs.

Orders from the automotive sector rose 2% year-over-year in 2023, “primarily from manufacturers of automotive transmissions,” AMT explained.

“While a lot of attention has been paid to investments in electric-vehicle production lines,” AMT offered, “automakers have also been heavily investing in production lines that make traditional internal combustion engines.”

The aerospace sector’s 2023 orders fell nearly 9% from 2022, which is less than the decrease for the overall market, which the organization noted has positioned aerospace shops to continue investing in 2024.

Within the regional results reported by AMT, only the Southeast produced a negative order volume (-7.0%) for December, while the North Central-West (+52.1%), West (+30.2%), North Central-East (+16.8%), and Northeast (+15.8%) concluded the year with a month of very strong order activity.

For the full year, none of the regions finished in positive territory versus 2022, but the Northeast (-2.3%) and South Central (-2.6%) came close to evening their totals versus the previous year. The worst year-over-year order volume was posted in the West region (-28.5%.)

“Orders of manufacturing technology outperformed expectations in 2023, and there are several reasons to believe the momentum will carry over into 2024,” according to AMT’s announcement. Citing the 7% year-over-year rise in cutting-tool shipments, the group noted that the increase in demand for consumables “indicates that machines in the field are increasing output. This is a good sign for machinery orders in 2024, as increased output could signal a coming need for additional capacity.”