U.S. manufacturers and machine shops ordered $398.9 million worth of new metal cutting and metal forming/fabricating machinery during September, a drop of -2.8% from the August total but -23.4% lower than the year-ago result for September 2022. It’s notable that September 2022 included orders placed during IMTS 2022, historically a peak opportunity for buyers to book their orders.

Through nine-months of activity, U.S. machine tool orders totaled $3.64 billion, which is -13.8% less than the total for January-September 2022.

“Though 2023 orders are down, activity is still above long-term historical averages, indicating relative health overall,” according to Douglas K. Woods, president of AMT – the Assn. for Manufacturing Technology. AMT’s monthly U.S. Manufacturing Orders Report tracks new orders as an indicator of future manufacturing activity, as machining operations prepare to undertake new production programs.

“We are still seeing strength in key industries, with contract machine shops, medical, and automotive continuing to invest heavily in manufacturing technology,” according to Woods.

A similar trend in machine tool orders is underway in Germany, though VDW recently reported there are no indicators of a rebound in new orders.

AMT noted that contract machine shops have increased the value of their orders by nearly one-third versus the same figure for last year, though the number of machines (units) ordered to-date has increased by less than that margin. A similar comparison is found among the orders from manufacturers of medical supplies, where overall spending has increased “dramatically,” according to AMT.

Manufacturers in the automotive supply chain are continuing to increase the volume of their orders, despite the production outages resulting from the United Autoworkers union strike against General Motors, Ford, and Stellantis. AMT pointed out that longer timelines for production of new automotive programs, as well as ongoing demand for new vehicles, allowed the automakers to continue capital spending during September as the strikes were ongoing.

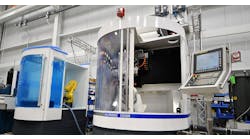

“The disparity in manufacturing technology investment across industries indicates that not all are paring back capital spending at once,” Woods explained. “Industries that are spending healthily on manufacturing tech appear to be shifting expenditures toward highly automated machinery as evidenced by rising per-unit values.”

AMT also noted that 2023 YTD orders are above the historic averages, with several industries indicating strong growth.

“Industries supported by high consumer demand and benefiting from long production timelines continued to be reliable customers of manufacturing technology,” Woods stated. “We are detecting a shift in capital goods investment toward improving productivity through adoption of manufacturing technology automation.”