Machine Tool Orders Down for Third Straight Month

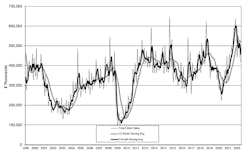

U.S. machine shops’ and other manufacturers’ new capital-equipment orders slipped to $417.5 million during June, down -5.1% from the May total and the third consecutive month of falling order values. The June “manufacturing technology” order total also represents a -16.0% year-over-year drop in value, though with $2.84 billion in year-to-date new orders, 2022 has improved 13.1% over the six-month order total for 2021.

“Being ahead of our best year on record to start 2022 is a good sign for the industry,” stated AMT-the Assn. for Manufacturing Technology president Douglas K. Woods. “That said, we are beginning to see the normal trend of decreased orders through the summer months.”

AMT publishes a monthly summary of new order totals in its U.S. Manufacturing Orders report, compiling nationwide and regional data for metal-cutting and metal-forming and -fabricating machinery. The USMTO report serves as a forward-looking indicator of overall manufacturing activity, as machine shops and other manufacturers make capital investments in preparation for demand expected in the weeks and months ahead.

The forward-looking aspect of new-order totals have kept USMTO totals ahead of the 2021 pace during much of the current year, though manufacturers have struggled to gain stability versus the range of complications in the industrial sector, including steadily rising inflation, the ongoing supply-chain disruptions, and the long-standing difficulty of locating skilled workers. The Russia-Ukraine war has disrupted many plans and contingencies, too, according to various reports.

Detailing that value of June 2022 new orders was about 14% higher the average value for June, the number of machine-tool ordered was down by about 12%. “While some of this disparity is surely due to inflation, a much larger share is the addition of automation – which has become ever more necessary to keep production up as the labor market grows tighter,” according to Woods. “Decreasing price points and increasing ease of use has accelerated automation adoption in industries that were typically hesitant to take the plunge.”AMT also confirmed that supply-chain issues continue to be a problem for manufacturers, including extending the lead times for new manufacturing-technology equipment. “Typically, shops with an order in hand need to begin making parts and may not be able to wait for new machinery to be delivered,” Woods said. “When making less-complex parts, some of the demand that would normally go toward new machinery is now being redirected to the used market.”

While the regional order data reported for June is not entirely complete, three of six regions reported month-to-month increases in new orders: +19.7% in the Southeast, +25.5% in the South Central, and +6.8% in the West region. The Northeast region reported a -20.0% decrease in June from May.

Only one of the regions with full data available for June posted a year-over-year rise in new orders: the North Central-East, where new orders were up 2.6% from June 2021.

Three regions showed improvement in their January-June new-order totals: +31.9% in the South Central, +21.6% in the West, and +2.2% in the Northeast.

AMT also noted that some industrial sectors report increasing order totals for June. “The manufacturers of construction machinery ordered the most new equipment since June of last year,” according to Woods. “This is likely in anticipation of additional capacity needs to implement the infrastructure bill which became law last November.”

Woods predicted that trend in declining order totals would reverse next month with the staging of IMTS 2022, the biannual trade expo for machine tools and machining technology, in Chicago September 12-16. “September orders in an IMTS year tend to exceed non-IMTS September orders by nearly $180 million,” he noted. “In addition to the immediate 'September effect,' orders following an IMTS tend to remain elevated for the remainder of the year.”