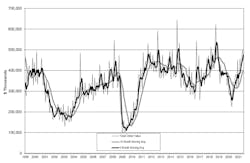

New orders for machine tools by U.S. machine shops and other manufacturers rose to $560 million during August, up more than 19.0% from July and 89.0% higher than the August 2020 new-order total. It was the fifth month-to-month rise in U.S. Manufacturing Technology Orders during 2021 and brings the eight-month total for new orders in 2021 to $3.55 billion, 53.5% higher than the January-August 2020 total.

“The August numbers highlight the dramatic rebound from sales in 2020,” stated Douglas K. Woods, president of AMT – the Assn. for Manufacturing Technology, which issues the monthly USMTO report.

“It was the highest level of orders since September 2018 and the sixth-highest in the history of USMTO,” Woods continued.

USMTO is a forward-looking index to manufacturing activity, presenting actual data for capital investments in new machine tools. The total reflects machine shops and other manufacturers planning for future work orders – specifically, new orders of metal-cutting and metal-forming and -fabricating equipment.Woods noted that the value of orders by machine shops hit the highest monthly total since September 2014, which he said reflects “OEMs placing more off-shore component business onto their floor in addition to the expansion of their traditional customer base.

“Computer and peripheral equipment manufacturing had a massive increase in orders,” Woods elaborated. “Orders from the aerospace sector increased modestly over July 2021 but still lagged behind their pre-pandemic spending. Forecasts expect output from the aerospace sector to increase steadily through 2024, requiring an eventual increase in the volume of orders.”

The USMTO report includes data for new orders nationwide and in six geographic sectors, based on information supplied by participating producers and distributors of that equipment.

In regard to the regional results, the August totals were notably stronger in the South Central (+55.0% month over month) and North Central-West (+31.2%) regions than in the West (+26.3%) and Southeast (+23.9%) – and considerably more robust than in the Northeast (+7.2) and North Central-East (+1.3%.)

Woods addressed those disparities too: “The uniform growth in orders across industries seen earlier this year was reversed in August, when monthly growth across industries ranged from a decline of 16% to growth in excess of 400%.”

AMT identified a “steady downward trend in consumer confidence since its peak in April 2021,” and reported that its own research indicates “the abnormal summer surge in manufacturing technology orders could serve as an economy-wide stabilizer.

“Capital investment can alleviate the bottlenecks producers are experiencing due to labor-supply issues,” according to the group’s release. “This can, in turn, reduce the pressure of inflation consumers are feeling by bringing supply and demand closer to alignment. Assuaging the fears of consumers would lead to more demand and could sustain the tidal wave the manufacturing technology industry is currently riding.”