Machine Tools Orders Closed Strong in 2020

U.S. manufacturers ordered $456.7 million worth of new capital equipment during December 2020, a 40% rise over the November 2020 total and a 17.6% increase from the December 2019 total. “In December, the manufacturing technology industry saw growth in all geographic regions of the country as well as across the majority of manufacturing sectors,” said Douglas K. Woods, president of AMT – the Assn. for Manufacturing Technology, which tracks the data as part of its monthly U.S. Manufacturing Technology Orders (USMTO) report.

Woods pointed to “significantly better” performance by the aerospace sector as one factor in the strong performance during December.

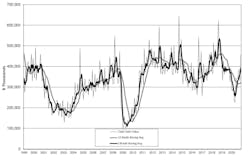

For the full 12 months of 2020, U.S. machine shops and other manufacturers ordered $3.87 billion worth of new machine tools – which is -15.3% less than the full-year volume for 2019. That decrease should be understood within the worst-case scenarios offered by industrial analysts at the start of the shutdowns undertaken to halt the spread of the COVID-19 virus.

“Last spring, industry economic forecasters were predicting a 50% decline in manufacturing technology orders for the year amid U.S. industrial production contracting at a lower annualized rate than any point during the Great Depression,” Woods noted.” But as 2020 closes, we can now confirm that orders were down only 15% for 2020. Given the strength of December, and with pent up demand, depleted inventories, continued reshoring, several COVID vaccines, and a lot of cash on the sidelines, things bode well for a positive start to 2021.”

The USMTO regional summary for December new orders showed double-digit monthly increases in new orders in every geographic sector and encouraging year-over-year improvements too.

As for full-year results, the best performance came from the Southeast region, which posted $537.4 million in orders for January-December, -8.3% compared to the previous 12 months.

In the other regions, the annual results were: Northeast, $678.8 million, -22.0% year-over-year; North Central-East, $930.12 million, -12.6%; North Central-West, $682.11, -12.8%.

In the South Central region, metal-cutting machine orders for 12 months of 2020 totaled $270.05 million, -27.6% year-over-year; and in the West metal-cutting machine orders for 2020 totaled $730.32, -12.2% versus January-December 2019.