Reading the direction of manufacturing technologies demands more than an understanding of the capabilities of information technology, network design and performance, and automation, to list a few of the influential factors at work. A forecaster also has to understanding the various markets’ requirements and the timing of new technological developments. Antony Bourne, the Global Industry Director of Industrial and High-Tech Manufacturing for enterprise-software developer IFS, has over 20 years of experience in IT, including in manufacturing. These are his top trends for the manufacturing in the year ahead.

1. By the end of 2018, over 50% of manufacturers will be incorporating “Internet of Things” technology during the design phase of their products.

When you think IoT, is your first thought available, and newly affordable sensors being added to products after they’ve been manufactured? If it is, well I believe 2018 will change that perception as IoT evolves in a decisive way. If we think of IoT as a product’s “nervous system,” 2018 will see it develop from picking up signals at the periphery of awareness to being the brain of the product—constantly sending, receiving, expanding, and gathering information, from the center of the product, throughout its lifetime, and in this process enabling new services and revenue streams.

Manufacturing already is one of the markets most heavily impacted by IoT. According to Global Market Insights, IoT in the manufacturing market was valued at over $20 billion in 2016 and will grow at more than 20% (CAGR estimate) from 2017 to 2024. Current IoT investments that are unique to the manufacturing environment are taking place according to three major initiatives:

• Smart manufacturing to increase production output, product quality, or operations and workforce safety, as well as lower resource consumption;

• Connected products to impact product performance, including collecting detailed information on products in the field, remote diagnostics, and remote maintenance;

• Connected supply chains to increase visibility and coordination in the supply chain, tracking assets or inventory for more efficient supply-chain execution.

In 2018, we will see IoT being included as a part of the design process in relation to each of these IoT initiatives. Manufacturers are realizing that by engineering IoT technology into products and equipment already in the design process, they will be able monitor not only the equipment’s performance to predict when it needs repair, but also how and when it is being used — providing game-changing competitive advantages.

By the end of 2018 more than 50% of manufacturers will be building IoT technology into their products from day one—already thinking forward in the design phase and asking themselves, “What services and revenue can this product generate throughout its lifetime?”

In fact, they might also be wondering, “Where will our revenue be coming from in the next five years?” It’s a question that leads to my next prediction …

2. "Servitization" speeds ahead: By 2020, most manufacturers will earn over half of their revenue from the services they provide to customers.

With the manufacturing industry becoming more and more commoditized, the need for enterprises to differentiate is critical to survival and profitability. We already see a large number of manufacturers shifting to a more service-centric business model: the buzzword is “servitization.”

Servitization is a way for a manufacturer to add capabilities to enhance its overall offering, in addition to the improving the particular products. The famous example is Apple, which achieved servitization a few years ago when it had gained the majority of market share with the iPod and introduced iTunes to increase loyalty, differentiate itself, and generate more revenue. You may think that it will never apply to your business, but manufacturing companies now are reaping the benefits of servitization across many different sectors.

For example, at Amsterdam’s Schiphol airport Philips provides “lighting as a service”, which means that Schiphol pays for the light it uses while Philips remains the owner of all fixtures and installations. Philips and its partner Cofely will be jointly responsible for the performance and durability of the system, and ultimately its re-use and recycling. This has resulted in a 50% reduction in electricity consumption without the airport authority having to buy a lamp!

I see this development among IFS customers, too. For furniture manufacturer Nowy Styl Group, servitization has been crucial to its global growth. In 2007 it announced, “For us, chairs are not enough,” starting a transformation from pure manufacturer to world-class office interior consulting company.

Another example is a customer that manufactures cleaning products and started to offer delivery and service dosing systems. This company understood that choosing the right cleaning products was just part of its customers’ main objective, i.e. keeping its premises hygienic. Applying the products in the most effective way, choosing the right accessories, establishing the right routines— all these too were crucial to keeping premises clean.

Both these customers realized that with technology accelerating as quickly as it is, no matter how beautifully designed a chair may be, or how effective a cleaning product is, today’s luxury products turn into tomorrow’s commodities faster than ever, pulling prices down with them. With servitization, manufacturers escape the corrosion of commodification. Expert services built on years of experience provide a kind of value customers will always pay for, regardless of technology trends.

According to the IFS Digital Change Survey, conducted by research/publishing firm Raconteur, 68% of manufacturing companies claim that servitization is either “well-established and is already paying dividends” or “in progress and is receiving appropriate executive attention and support.” However, almost one in three manufacturing companies have yet to derive value from servitization. These are missing out on revenue streams and new ways to develop their offerings. To respond successfully to customers’ needs and increasing demands, manufacturers must look to new business models to compress time-to-market, taking an idea from design through to a point-of-sale product as quickly as possible.

New technologies related IoT adds additional layers to servitization. With sensors detecting when a product or equipment needs service, this data can trigger an automated service action that will realize significant benefits to make a service organization more effective. This type of automated predictive maintenance will become more and more common, as it is a natural step to follow IoT implementation, to optimize service efforts.

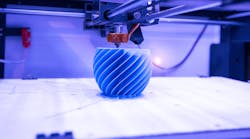

3. By 2019, the hype around 3D printing will be over, and real benefits will be blooming.

My third prediction is that 3D printing, just like IoT, will enter a new, more mature phase. No matter how big the ‘wow’ factor is when we first see it, apart from smaller-scale manufacturing production like hearing aids and jewelry, 3D printing has so far failed to live up to its full potential. All this could change in 2018.

We already see a few developments that point in that direction. The first of these is the improved scalability of 3D printing solutions. A new generation of 3D printing companies is moving into manufacturing with new, faster, better-connected automated systems that reduce some of the time-consuming pre- and post-processing that have been such obstacles to wide-scale uptake. Stratasys has collaborated on a new printer, the Demonstrator, that combines three printers into a stack system—each printer able to communicate to its neighbors in real time. This new printer is highly scalable, meaning it can significantly increase production capacity, printing from 1,500–2,000 components per day. This means that a manufacturer can achieve an economy of scale to bring down costs, which will be a catalyst for the expansion of 3D printing technology.

The aviation sector is pioneering 3D printing technology today, and other manufacturers can learn from that example. One success is the new GE Aviation turboprop ATP Engine, which features 35% 3D-printed content, reducing the finished system from 855 components to 12. This contributed to a lighter, more compact engine that delivers a 15% lower fuel-burn rate and 10% higher cruise power compared to competing products.

The expanded capacity and reduction in pre- and post-processing that new, innovative mid-sized 3D printing companies are introducing for industrial manufacturing prompt me to predict that, in 2018, we will see more manufacturing companies match the high-flying 3D-printing achievements of aerospace and defense firms.

Antony Bourne is the Global Industry Director of Industrial and High-Tech Manufacturing for IFS, a developer of enterprise software for manufacturers and distributors. He has over 20 years of experience in IT, including in manufacturing, and he held business analyst positions with Ford Motor Co. and AlliedSignal. Contact him at LinkedIn, or visit www.IFSworld.com