Cutting Tool Demand Improves, but Faces Uncertainty

New orders for cutting tools improved 9.1% from July to August as manufacturers purchased a total of $209.3 million worth of the critical supplies during the latter month, according to latest Cutting Tool Market Report by the U.S. Cutting Tool Institute and AMT - the Assn. for Manufacturing Technology.

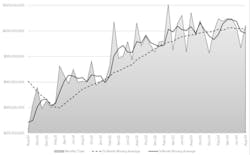

While the August figure reverses a three-month trend of falling purchases for cutting tools, the result is -4.5% less than the August 2023 order volume.

“U.S. cutting tool orders have hit significant headwinds as we move into the fourth quarter of 2024,” according to USCTI president Steve Boyer. “We saw drop-offs in orders for two of the last three months of the third quarter of this year compared to last year.”

The current year’s total purchases of $1.67 billion represent an improvement of just 1.5% over January-August 2023.

Everede Tool Co. president Bret Tayne observed that “Sales of industrial metal-cutting tools seem to have plateaued. We can look past some of the ‘noise’ by focusing on the 12-month moving average, and that is flat. This conclusion seems to be consistent with what we read about the broader economy.

“We are at an inflection point,” Tayne continued: Some macro data points to a recession, and other data indicates we may avoid it.”

According to Boyer, “Challenges continue with work stoppages in the aerospace sector. Instability in world events is also significantly impairing market confidence as we finish out 2024. Defense spending continues to be strong, while other markets have shown some stagnation. Early expectations for continued growth in 2025 originally showed promise, but a lackluster 2025 is probably more realistic with so many factors in flux.”

The Cutting Tool Market Report is a monthly summary of shipments made by companies who comprise the majority of the U.S. market for cutting tools – whose customers are contract machine shops (job shops) and OEMs for whom cutting tools are significant consumable. Because of the wide range of markets served by cutting-tool buyers, the CTMR is considered a relevant indicator of overall manufacturing activity.