Cutting Tool Demand Growing Weaker

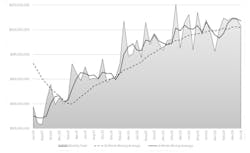

Cutting tool purchases fell -2.9% in value from May to June 2024, totaling $208.1 million in the latest Cutting Tool Market Report issued by AMT - the Assn. for Manufacturing Technology and the U.S. Cutting Tool Institute. The June figure is also -4.2% lower than the June 2023 result, and it brings the January-June 2024 value for cutting tool purchases to $1.27 billion – which is still 2.6% higher than last year’s six-month total.

“While 2024 started on a positive note, we have seen significant stagnation in several markets utilizing cutting tools,” offered Steve Boyer, president of USCTI. “Aerospace has seen many challenges this year, and while we expect to see that market improve in 2025, it has impacted growth for 2024. Modest gains have been realized with orders for the automotive markets but have not fully offset some of the slides attributable to the aerospace industry.

“While tempering our enthusiasm for the second half of 2024, expectations for cutting tool order growth are still very positive for 2025,” Boyer added.

USCTI and AMT’s monthly Cutting Tool Market Report, summarizes shipments made by companies who comprise the majority of the U.S. market for cutting tools – whose customers are contract machine shops (job shops) and OEMs for whom cutting tools are significant consumable.

Manufacturers’ demand for cutting tools closely matches U.S. durable goods shipments as a measure of overall industrial activity, and according to an analyst cited by AMT the remainder of 2024 does not appear to result in increased manufacturing activity.

“Cutting tool demand is likely to show further softness in the second half of 2024, driven by widespread inventory liquidation in many industries,” explained Eli Lustgarten, president of ESL Consultants. “While there are pockets of strength in markets such as government-financed infrastructure and data centers, the farm equipment sector will show dramatically lower production in the second half of 2024. Energy, construction, and mining sector output will decline.

“Heightened uncertainty also exists in automotive and commercial aerospace markets,” the expert noted.