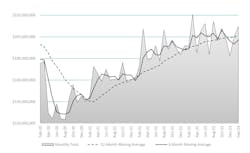

In a critical indicator of the strength of industrial activity, U.S. machine shops and other manufacturers ordered $214.6 million worth of cutting tools during February, +4.9% more than during January and +9.0% more than during February 2023. The two-month order volume for 2024 is $419.1 million, +6.5% above the total for January-February 2023.

The figures are drawn from the monthly Cutting Tool Market Report, compiled by the U.S. Cutting Tool Institute and AMT - the Assn. for Manufacturing Technology.

Cutting-tool purchases are a marker of overall manufacturing activity because those purchases reflect production across a range of manufacturing market segments served by machining operations. Data in the report summarizes purchases by companies participating in the CTMR program who comprise the majority of the U.S. market for cutting tools – whose customers are contract machine shops (job shops) and OEMs for whom cutting tools are significant consumable. Their demand for cutting tools closely matches U.S. durable goods shipments as a measure of production activity.

“After some declines in orders to end the fourth quarter of 2023, the U.S. cutting tool industry has seen rebounds in monthly orders and growth in shipments to begin the first quarter of 2024,” according to Steve Boyer, president of USCTI.

“Inflation continues to add some apprehension for upcoming quarters, but the industry continues to positively show growth even if that pattern is of uneven growth,” Boyer added.

Everede Tools Co. president Bret Tayne noted that the February increase in cutting-tool sales happened against a backdrop of “unease and uncertainty in the general economy”.

“The yield curve remains inverted, and inflation remains stubbornly high,” he noted. “The commercial aircraft sector is in a challenging period. Automobile manufacturers have become increasingly concerned about the direction of the EV market. Elections are approaching, and consumer sentiment is volatile.

“It will be interesting to see if the cutting tool industry can maintain momentum over the next several months,” according to Tayne, suggesting some uncertainty of his own.