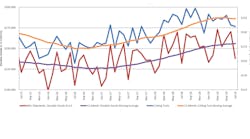

U.S. machine shops and other manufacturers purchased $198.4 million worth of cutting tools during July, slightly (-0.6%) less than during June but 2.6% more than during July 2018. Cutting-tool consumption is an indicator of the rate of manufacturing activity, as cutting tools are the primary consumable product for machine shops and other manufacturers. As such, the July result suggests some moderation in the pace of the manufacturing recession indicated recently in the Federal Reserve Bank’s report on Industrial Production and Capacity Utilization (G.17).

For the current year to date manufacturers’ cutting-tool consumption totals $1.5 billion, meaning that 2019 is up 2.6% compared to the January-July 2018 period.

Data on cutting-tool consumption is provided by the monthly Cutting Tool Market Report issued by the AMT – the Assn. for Manufacturing Technology and the U.S. Cutting Tool Institute (USCTI.) CTMR data is based on actual results provided by participating manufacturers and distributors, who represent the majority of the U.S. market for cutting tools.

According to Brad Lawton, chairman of AMT’s Cutting Tool Product Group, “While orders for production machines are down 12% (YTD), cutting-tool shipments are still holding up in comparison to 2018 figures. The impending downturn in investment is expected to be short and shallow, but it is still likely to yield a couple of tough quarters for cutting-tool manufacturers.”

“The Purchasing Managers’ Index dip below 50 in July suggests that the year over year growth in cutting tools is likely to turn negative when August shipment levels are published," according to Dave Burns, president of Global Business Advisory Services LLC. “Still, some industries’ demand for cutting tools continues to expand as cautiousness shifted production downstream deeper into the supply chain or into contract machine shops.”