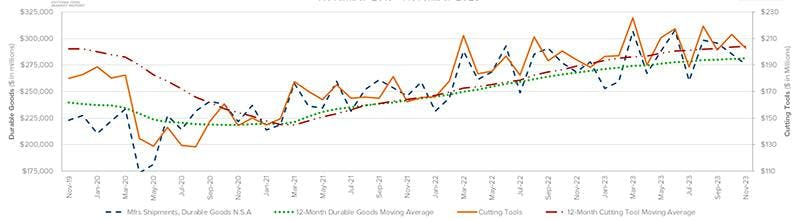

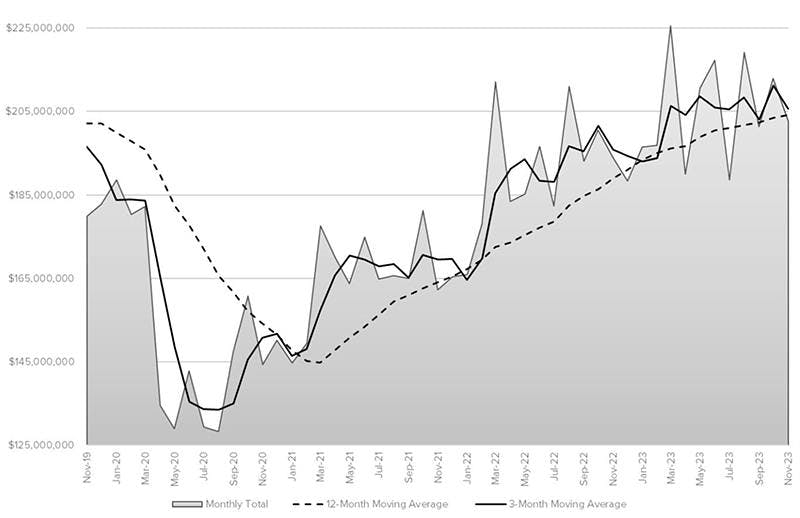

U.S. manufacturers, including machine shops, reduced their consumption of cutting tools by -4.9% from October to November 2023, totaling $202.7 million in a critical indicator of manufacturing activity. Following an uptick in the October result, the monthly Cutting Tool Market report index signaled a return to the uncertain direction that marked cutting-tool consumption during the last half of 2023.

Cutting tool consumption is indicative of overall manufacturing activity because those purchases reflect the volume of activity by machining operations across a range of manufacturing market segments.

Even allowing for the month-to-month decline for November, the new figure is 4.4% higher than the November 2022 result – and with an 11-month total of $2.26 billion, 2023 cutting-tool consumption rose 7.5% versus the January-November 2022 result.

“Despite predictions of a recession in 2023, the economy has glided into what appears to be a soft landing,” commented Christopher Chidzik, principal economist at AMT. ”To support this steady economic activity, cutting tool shipments have been on a reliably upward trend since they hit bottom in mid-2020.”

AMT Cutting Tool Products Group chairman Jack Burley explained that “aerospace and automotive markets are still working on an impressive backlog and sales that will continue to keep most shops busy well into the new year.”

“Despite high inflation and interest rates, there is still a positive mood for most companies who are working in manufacturing. This should be good news for 2024 forecasts within our industry,” Burley added.

According to Chidzik, “cutting tool demand in 2024 should continue as long as consumer demand for durable goods remains elevated, businesses continue to invest in capital equipment, and government investment in infrastructure and manufacturing continue to come online.”

The CTMR is a collaborative effort by the U.S. Cutting Tool Institute (USCTI) and AMT – the Association For Manufacturing Technology .