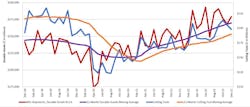

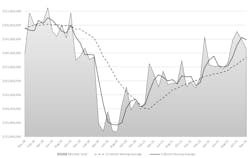

“Don’t sweat the month-to-month declines in the past two months; the story is in the year-over-year and year-to-date double-digit increases,” offered Pat McGibbon, chief knowledge officer for AMT – the Assn. for Manufacturing Technology. “The next 12 months look bright for 2023 in tooling, as record backlogs in material-removal equipment orders convert into shipments and expanded capacity.”

Cutting tools are consumable products, the purchases of which serve as an index to overall manufacturing activity due to the range of market segments driving machine shops’ purchases. The data is compiled by the U.S. Cutting Tool Institute and AMT – the Assn. for Manufacturing Technology for their monthly Cutting Tool Market Report, which represents actual purchases of cutting tools as reported by manufacturers and distributors that comprise a majority of the domestic market for cutting tools. “In January, the U.S. labor market had its best month in job hirings since 1969, and cutting tool sales remained steady,” explained USCTI president Jeff Major. “The consensus is that the cutting tool industry looks positive for at least the first six months of this year. Economic pressures still exist, and the Federal Reserve continues to raise interest rates to stave off inflation.”