Slower Manufacturing Rates Weaken Tool Demand

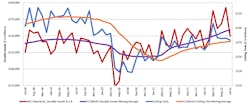

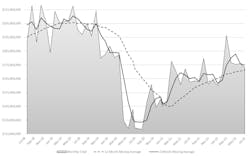

Machine shops and other U.S. manufacturers consumed $173.2 million worth of cutting tools during July 2022, -1.5% from the June consumption total and yet still 6.7% ahead of the July 2021 total. Through seven months of consumption data, U.S. manufacturers’ cutting-tool consumption has totaled $1.2 billion, 7.7% more than last year’s January-July total.

The data is supplied by the U.S. Cutting Tools Institute and AMT – the Assn. for Manufacturing Technology in their monthly Cutting Tool Market Report, which compiles data for actual purchases of cutting tools by companies representing a majority of the domestic market for cutting tools.

Cutting tool consumption is a reliable index to overall manufacturing activity because cutting tools are a primary consumable product in use across multiple industrial sectors.“The July 2022 cutting tool results continue to show demand is still well off 2019 levels,” commented Costikyan Jarvis, president of Jarvis Cutting Tools, noting that “2022 dollar volume is still running about 15% lower than 2019, and when inflation is considered, total unit production is even lower.

“This data is supported by 2022 vehicle sales being around 13 million units versus 17 million units in 2019, and the lower production (rates) in commercial aerospace,” Jarvis offered.The falling demand is “in line with the deceleration recently seen in new orders and a moderating pace of activity in key client markets,” according to Mark Killion, director of US industries at Oxford Economics.

However, Jarvis forecast that cutting-tool demand will improve in the months to come, and “well into 2023,” as commercial-aerospace manufacturing rates increase and automotive manufacturers resolve supply-chain problems.”