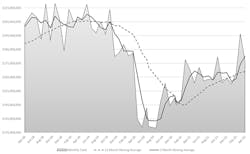

U.S. machine shops and other manufacturers consumed $175.5 million during April 2022, a -10.1% drop from the March consumption figure but still 3.8% ahead of the April 2021 total. The figures are supplied by the U.S. Cutting Tool Institute (USCTI) and AMT – the Association for Manufacturing Technology in their monthly Cutting Tool Market Report – an index to overall manufacturing activity, because cutting tools are a primary consumable across manufacturing sectors.

Through four months of activity, the year-to-date consumption total according to CTMR is $700.4 million, up 9.1% compared to January-April 2021.“Data from AMT and USCTI show April sales declined slightly from March, but the year-to-date sales are still outpacing 2021,” according to USCTI president Jeff Major. “Supply-chain issues and rising costs of manufacturing continued to hinder our business. The hope is that these factors will ease later this year. Our industry outlook continues to remain positive.”

While the industrial economy continues to be strained by an unreliable supply chain – supplies for parts and materials are inconsistent or unavailable, and many business continue to operate below capacity while struggling to fill open positions – the USCTI head’s comment acknowledges the growing concern for inflation’s effects on overall economic growth.“Orders (for cutting tools) should continue to track the increase in durable goods output as supply-chain issues somewhat ease, helped by below-normal industrial goods inventories and the upcoming IMTS in September,” offered Eli Lustgarten, president of ESL Consultants, an economic analyst cited by USCTI and AMT. “However, a growth slowdown for the U.S. economy is a near certainty, driven by the high level of inflation, global financial tightening, and economic weakness in Europe and China. The impact on the cutting-tool sector will likely be more volatility in monthly orders and possibly a flattening of demand with dollar sales growth likely to be driven by inflationary pressures.”

The CTMR presents cutting-tool consumption data reported by participating manufacturers who represent the majority of U.S. suppliers of those goods. CTMR results offer an index to overall manufacturing activity, because cutting tools are a primary consumable across manufacturing sectors – widely used in the production of parts and components supplied to a very wide range of industrial sectors.