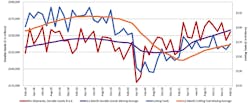

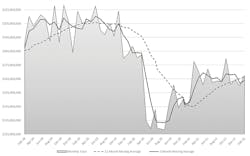

Machine shops and other U.S. manufacturers consumed $167.6 million worth of cutting tools during February, +4.8% more than the January total and +12.1% more than the February 2021 result – indicating manufacturing activity is maintaining some underlying stability despite broad challenges to the domestic industrial sector.

Through the first two months of 2022, cutting tool consumption totaled $327.5 million, +11.3% higher than the January-February 2021 total.

“The cutting-tool market started sluggishly in January but rebounded in February,” according to Jeff Major, president of the U.S. Cutting Tool Institute.USCTI and AMT – the Assn. for Manufacturing Technology publish the monthly Cutting Tool Market Report, from which the consumption data is derived. The CTMR presents cutting-tool consumption data reported by participating manufacturers who represent the majority of U.S. suppliers of those goods. The result offer an index to overall manufacturing activity, because cutting tools are widely used in the production of parts and components supplied to a very wide range of industrial sectors.

Cutting tool consumption is comparable to shipments of durable goods, showing the similar effects of overall activity in the manufacturing sector, according to the CTMR collaborators.

“The indices for durable goods and cutting tools continue to run parallel in an upward trend,” Major said. “With the supply-chain challenges and volatility overseas, many companies are looking at re-shoring, which should bode well for our industry in the future.”Costikyan Jarvis, president of Jarvis Cutting Tools, offered that monthly consumption data has been fairly even for the past year – and suggested that some manufacturing-sector problems may yet reveal themselves. “Monthly data since March 2021 has been averaging approximately $166 million per month with limited monthly variation.

“This contrasts with the overall economy, which experienced constant GDP growth over the same period,” Jarvis continued. “Of special concern is that during this period, the economy saw significant inflationary pressure, which would suggest actual output is even lower relative to 2019. The two main users of cutting tools, automotive and aerospace, continue to have challenges.”