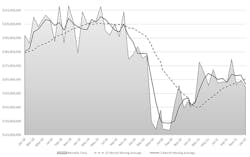

Machine shops and other manufacturing operations consumed $159.9 million worth of cutting tools during January 2022, according to the most recent Cutting Tool Market Report. The new total falls -2.7% below the figure for December 2021, but still shows 10.5% rise over than the consumption value for January 2021.

“As the cutting tool industry continues to adapt to the changing economic climate on the globe, we see the sales volume moving back toward the pre-pandemic levels,” according to Brad Lawton, chairman of AMT’s Cutting Tool Product Group. “Volumes that were expected to be higher were lowered by continued economic uncertainty, driven by inflation.”The monthly Cutting Tool Market Report compiles cutting-tool consumption data and portrays those results as an index to overall manufacturing activity, because cutting tools are widely used in the production of parts and components supplied to a very wide range of industrial sectors. It compares cutting tool orders to shipments of durable goods, showing the similar effects of overall activity in the manufacturing sector.

“Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true as it is a true measure of actual production levels,” the report’s sponsors explain.

The CTMR is presented by AMT – the Association for Manufacturing Technology the U.S. Cutting Tool Institute (USCTI), and tracks orders for cutting tools supplied by participating companies – which represent the majority of the U.S. market for those products.Despite the month-to-month decline indicated by the latest CTMR total, Steve Stokey, executive vice president and owner of Allied Machine and Engineering, said the January CTMR shows that “cutting tool data indicates we are continuing to trend in a positive direction, although the overall growth appears to be flattening.

“If manufacturing was not already dealing with enough challenges coming out of the pandemic, it will now see how the war in Ukraine and the energy policies of this administration impact the numbers moving forward.”