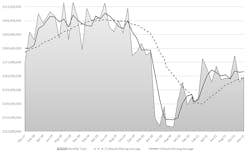

U.S. manufacturers’ consumption of cutting tools increased +2.2% from November to December, totaling $164.3 million to close out 2021. The monthly total represented a +9.5% rise over the December 2020 consumption total, and it brought the 12-month value for U.S. cutting tool consumption to nearly $2 billion, according to the monthly Cutting Tool Market Report.

The full-year total raised 2021 up +8.3% over 2020’s cutting-tool consumption volume, though the rate of expansion slowed in the final months of the year, apparently due to supply-chain complications and renewed pandemic-related issues.“The cutting tool industry continues to rebound from the pandemic's impact in 2020,” commented U.S. Cutting Tool Institute (USCTI) president Jeff Major. “Projections for 2022 are positive for the industry, with expectations of a full recovery to pre-pandemic levels in 2023. With that said, we still face headwinds from inflation, supply chain disruptions, and problems with workforce hiring and retention.”

The CTMR tracks manufacturers’ use of cutting tools as a reliable index to overall manufacturing activity, because cutting tools are widely used in the production of parts and components supplied to a range of industrial sectors. The monthly report is a collaborative effort by the USCTI and AMT – the Association for Manufacturing Technology, and it tracks sales of cutting tools by participating companies (representing the majority of the U.S. market for those product.)Bret Tayne, president of Everede Tool Co., noted, “December cutting-tool sales data continue to show a moderate upward trend. Year-over-year and YTD sales continued to improve at a pace similar to the prior three months, but at a slower pace than we experienced for April through August.

“It will be interesting to see how developments in January, such as the widespread increase in Omicron variant cases and Federal Reserve announcements on policy shifts, affect the next data set,” Tayne concluded.