Cutting-Tool Demand Slows Again, Amid Manufacturing Uncertainty

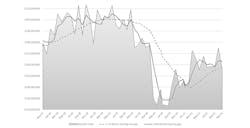

U.S. manufacturers’ consumption of cutting tools slipped -10.5% from October to November, totaling $144.3 million in the latest monthly report. The new figure is still 11.4% higher than the November 2020 total – demonstrating the ongoing improvement in the market since the recent low-point for domestic manufacturing during the Covid-19 pandemic.

Cutting-tool consumption is offered as a reliable index to overall manufacturing activity, because cutting tools are required in the production of a wide variety of parts and components supplied to a range of industrial sectors. The monthly Cutting Tool Market Report is a collaborative effort by AMT – The Association For Manufacturing Technology and the U.S. Cutting Tool Institute (USCTI), and tracks sales of cutting tools by participating companies (representing the majority of the U.S. market for those product.)

The -10.5% decline in cutting-tool consumption demonstrates that, “uncertainty continues in our market as indicated by the data: one month increase and then one month decrease for the last six months,” commented Brad Lawton, chairman of AMT’s Cutting Tool Product Group.That trend is evident in the year-to-date consumption total of $1.8 billion, meaning 2021 stands +8.2% higher than the previous January-November period.

Tom Haag, president at Kyocera SGS Precision Tool noted, “The industry is clawing its way back to pre-pandemic activity, but it is not on a linear path, as each month brings new challenges. How will the Omicron variant affect industrial productivity? When will the microchip shortage in automotive production end?”

Haag continued: “We are optimistic that 2022 will continue that progress in the industry, but full recovery is still in the distance.”