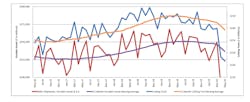

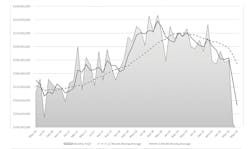

Cutting-Tool Demand Drops -36% in May

U.S. machine shops and other manufacturers purchased $136.6 million worth of cutting tools during May, a -4.4% drop in consumption from the April total — $142.9 million, which had been a -24.7% drop from the previous month. The May result also marks a -36.0% decrease from $213.4 million recorded for May 2019.

“The cutting tool market in May continued to shrink from April but at a much slower pace," observed Phil Kurtz, vice president of Business Development for cutting-tool developer Dormer Pramet. "We are now starting to see some market segments begin to stabilize and those segments should start to recover slowly in the months ahead.

“It is very possible April and May will represent the bottom of the cycle, but considering the volatility of the current market only time will tell,” according to Kurtz.Cutting tools are a primary consumable for all manufacturing processes, and manufacturers’ consumption of cutting tools parallels manufacturing activity in general, comparable to durable goods shipments. The monthly Cutting Tool Market Report issued jointly by the U.S. Cutting Tool Institute and AMT – the Assn. for Manufacturing Technology, presents cutting-tool consumption based on totals reported by participating companies, which represent the majority of the U.S. market for cutting tools.

Through the first five months of 2020, U.S. cutting tool consumption totals $854.1 million, down -18.8% compared with January-May 2019.

“The questions are, when will we see recovery, in the third quarter or after the first week of November?," he continued, "and will we return to the sales volumes experienced in 2018 and 2019? Whatever the answers, the facts are that the financial effects will be with the industry for an extended period.”