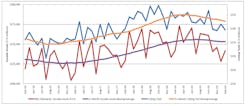

U.S. machine shops' and other manufacturers' cutting-tool purchases slipped to $188.2 million during February, down -4.2% from January and -8.5% from the February 2019 total. These results from the monthly Cutting Tool Market Report reflect the slowing domestic activity that preceded the widespread suspension of manufacturing in late March. According to U.S. Cutting Tool Institute Bret Tayne, “The most recently released February cutting tool statistics reflect the modest slowing we began to see in the latter part of 2019. But these numbers precede the effects of the COVID-19 fallout. I suspect we have all experienced a much steeper drop over the past several weeks.”

The CTMR is jointly issued by USCTI and AMT – the Assn. for Manufacturing Technology. Cutting tools are a primary consumable for all manufacturing processes, and U.S. manufacturers’ consumption represents a leading indicator for U.S. manufacturing activity, comparable to durable goods shipments.

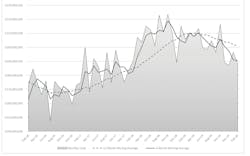

The CTMR differs from AMT's monthly U.S. Manufacturing Technology Orders report, which forecasts future manufacturing activity based on capital investment by machine shops and other manufacturers. The latest issue of that report showed similarly slow activity prior to manufacturers' effort to slow the spreading pandemic.

“With the economy facing a coronavirus-induced recession, the outlook through the summer will be challenging," Daco continued. "A stronger dollar, reduced international demand and higher corporate spreads will likely add to the sectoral headwinds. However, a gradual relaxation of lockdown measures in the latter part of 2020, along with unprecedented fiscal and monetary policy stimulus should help progressively support activity in 2021.”